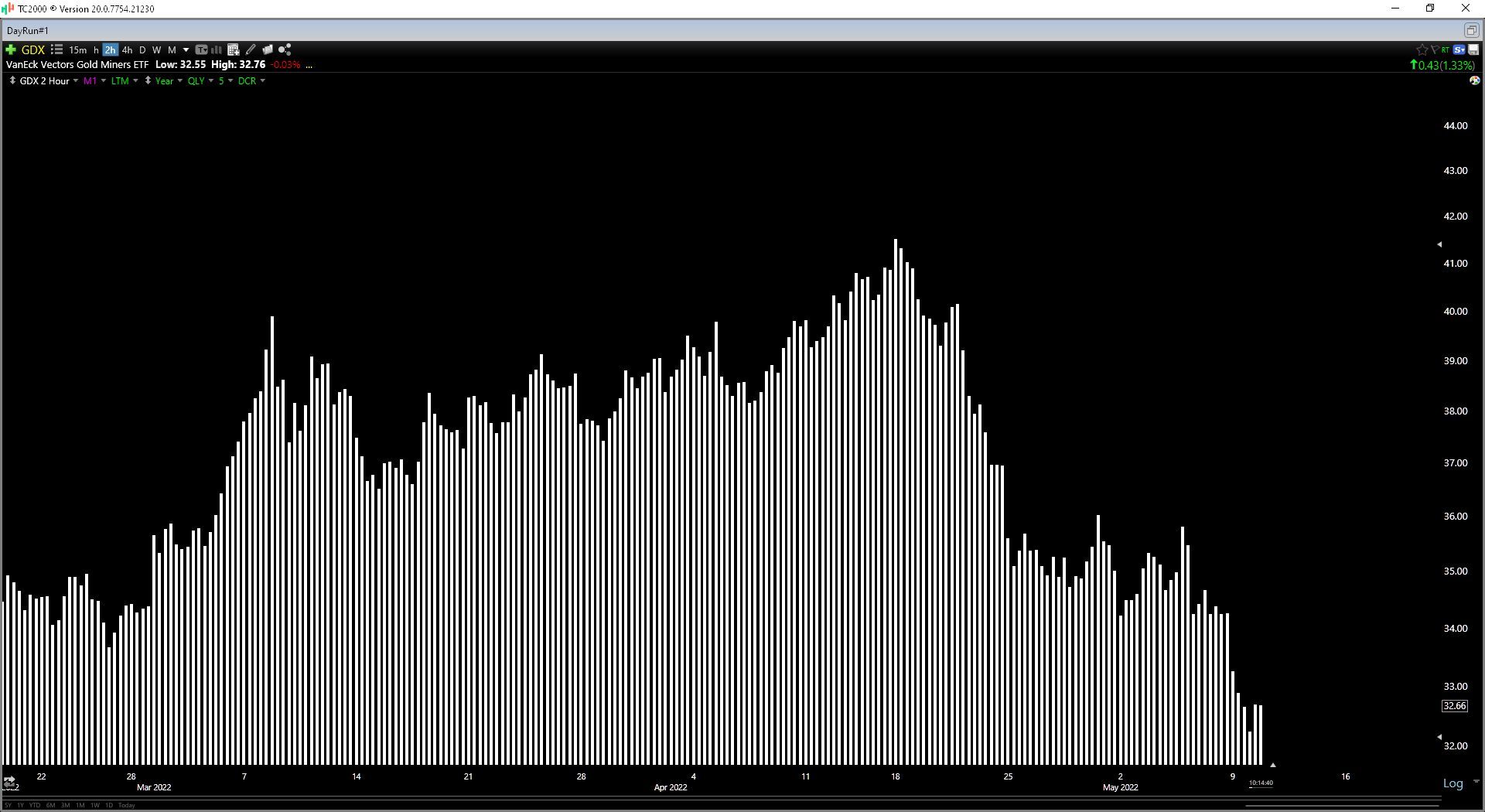

It’s been an ugly week for the major market averages, with the S&P 500 (SPY) continuing its violent decline from its Q1 highs. Prior to this week, the Gold Miners Index (GDX) was a sanctuary from the turbulence, but when the market heads past the 15% correction mark, few stocks are sheltered from the turbulence. While this has been painful for investors that chased miners in early Q2 near their highs, this is set up an excellent buying opportunity for patient investors. So let’s look at a few names in the GDX where the selling looks to be overdone:

Over the past month, we’ve seen several gold miners slide more than 25% from their highs, and in many cases, these corrections are entirely justified. This is because several producers have weak balance sheets and high costs, making them very sensitive to weakness in the metal price and rising interest rates. However, when it comes to names like SSR Mining (SSRM), Yamana Gold (AUY), and Barrick (GOLD), which are sitting in net cash positions or expect to be net-cash positive by Q4, the recent pullback makes little sense, especially given that they’re some of the best operators sector-wide. Continue reading "Three Gold Miners To Buy On Dips"