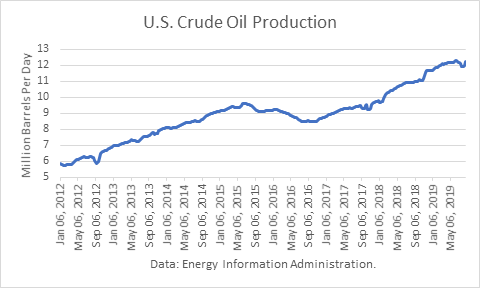

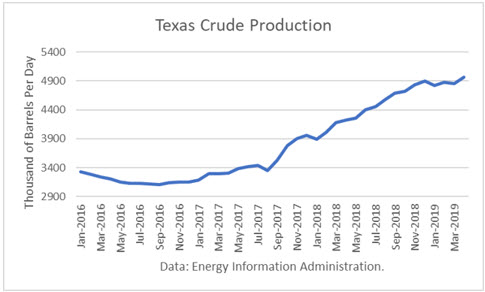

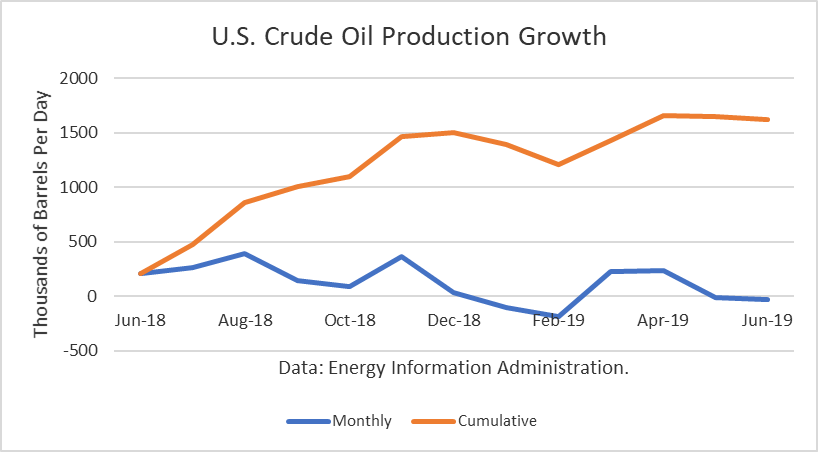

The Energy Information Administration reported that June crude oil production averaged 12.082 million barrels per day (mmbd), down 33,000 b/d from May. The drop resulted from a drop of 58,000 b/d in Oklahoma. Production gained the most in North Dakota (58,000) and Colorado (19,000) while production in Texas was only up 13,000 b/d.

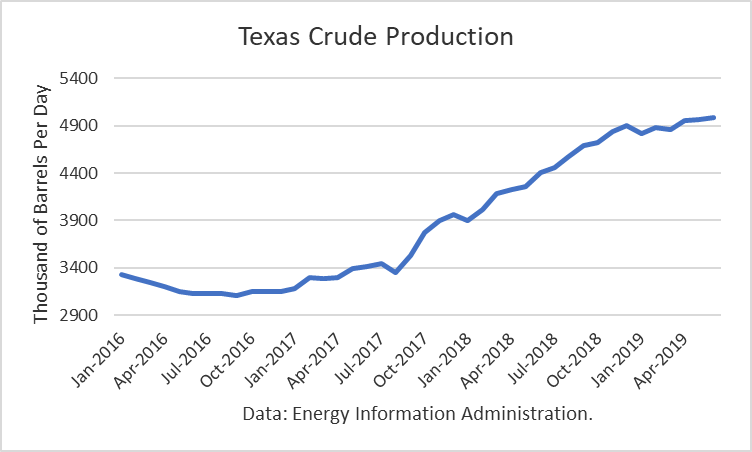

A pause in the growth rate in Texas had been expected due to pipeline constraints, which are expected to be alleviated in the second half of 2019 and first half of 2020. Nevertheless, Texas production reached a new all-time high of 4.982 mmbd.

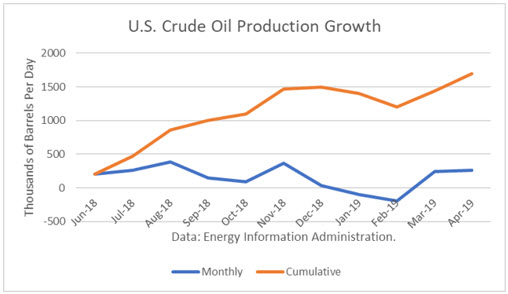

The year-over-year gains have been especially impressive with the June figure being 1.410 mmbd. And this number only includes crude oil. Other supplies (liquids) that are part of the petroleum supply add to that. For June, that additional gain is about 540,000 b/d. Continue reading "U.S. Crude Production Growth Paused In 1H19"