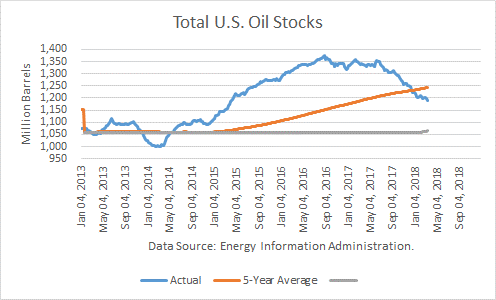

According to the Energy Information Administration (EIA), world oil production will exceed demand for much of the balance of 2018, and therefore global OECD oil inventories are projected to rise. Specifically, the EIA estimates that OECD inventories bottomed at the end of March at 2.784 million barrels (mmb) and will rise by 80 mmb through year-end, up 26 mmb from December 2017. And its projections through 2019 show another net stock gain of 34 mmb to end the year at 2.898 mmb.

The DOE forecasts for 2018 and 2019 are based on dramatically different seasonal stock changes that occurred in 2017. OECD stocks fell by over 147 mmb from August through December, according to the latest estimates. But in 2018, it is predicting a net stock build over those same months.

In 2019, it is forecasting a build similar to 2018, but without a first-quarter draw. Continue reading "Updated World Oil Forecast For April"