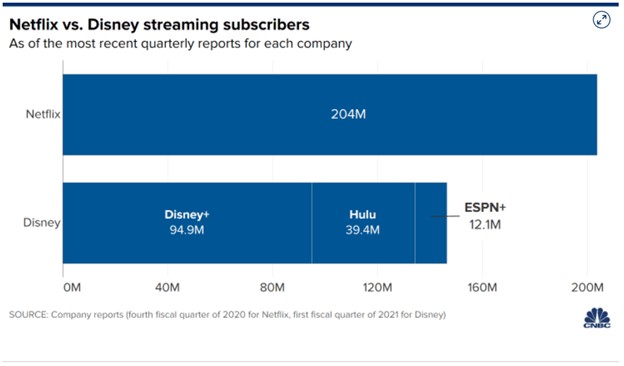

Disney (DIS) has been the sweet spot of capitalizing on the pent-up post-pandemic consumer wave of travel and spending while being the new and preferred stay-at-home content provider via Disney Plus. Over the past couple of years, Disney has rolled out and refined its wildly successful array of streaming initiatives that catered to the stay-at-home economy during the pandemic. These streaming efforts have transformed Disney’s business model, which its legacy businesses will further bolster as the world economy prospects continue to improve and reopen. Taken together, Disney has set itself up to benefit across the board with its streaming initiatives firing on all cylinders and theme parks coming back online. The company has been posting phenomenal streaming numbers that have negated the negative pandemic impact on its theme parks. This streaming-specific narrative will change as the theme park revenue comes back online and flows into the company’s earnings. Due to the tremendous success of Disney Plus, the company is now flexing its pricing power muscle and put through pricing increases on its streaming platform. This pricing power speaks to the value of Disney Plus as a standalone streaming platform while expanding its margins on this new business vertical. Disney presents a compelling buy for long-term investors as its legacy business segments get back online in conjunction with its wildly successful streaming initiatives, all of which have more pricing power down the road.

Pricing Power Flexing

Disney recently pushed through another price increase on its monthly subscription tier for its Hulu offerings. This is on top of price increases that it pushed through on its Disney Plus subscription earlier this year. Clearly, the Disney streaming platforms possess pricing power as the adoption of these steaming properties by consumers becomes more widespread. Part and parcel with these price increases is margin expansion and increased revenue. Disney has forecasted that its Disney Plus streaming platform will have up to 260 million subscribers by 2040. Thus, even marginal price increases will translate into meaningful revenue windfalls for the years to come. Continue reading "Disney - Flexing Its Pricing Power Muscle"