The market rally during the shortened holiday trading week of November 21st-25th should not be trusted just yet.

The Dow Jones Industrial Average rose 1.78% during the week, the S&P 500 increased by 1.53%, and the technology-heavy NASDAQ grew by 0.72%.

The move higher came for several reasons, but none materially changed the economy's outlook over the coming six to twelve months.

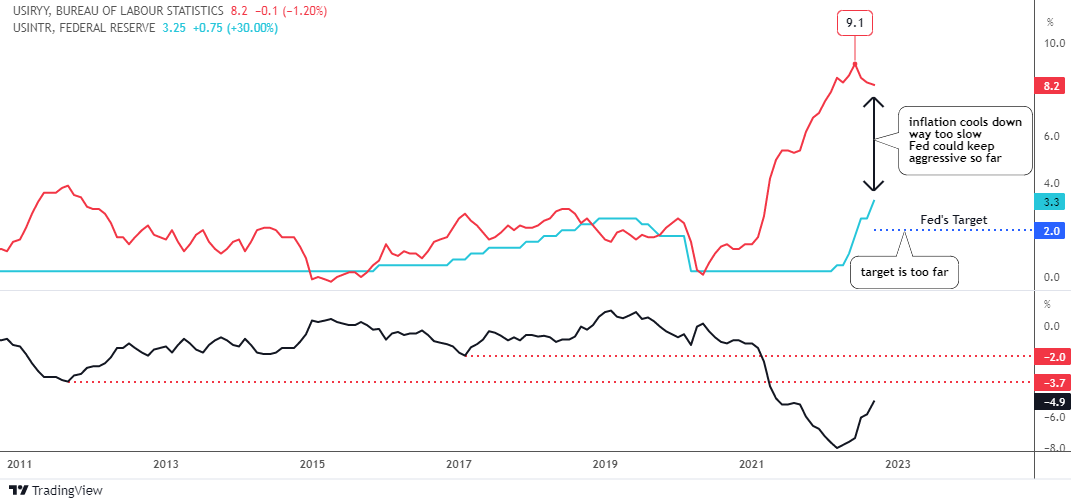

The biggest news was from the Federal Reserve. The Fed's meeting minutes from their November 1st and 2nd meeting pushed prices higher after several Fed members expressed interest in slowing the pace of rate hikes during future meetings.

Just the fact that the Fed is talking about reducing the amount of their rate increases is significant, and many economists applaud this move. Economists are happy with this because the Feds policy changes have a lag, meaning it takes time for rate increases to show in economic data reports.

The concern has been the Fed is raising rates too quickly, and by the time the lag sets in, the economy will be in the dumps. So, slowing the pace today is a possible way the Fed can avoid running the economy into the ground. Not running the economy into the ground is the "soft landing" we often hear about when people refer to the Fed and its current policies.

Another catalyst for the recent move higher was the Consumer Price Index in October, which was up 7.7% from a year ago. This was the lowest CPI reading increase since January of this year. But, let's be honest, a 7.7% increase year-over-year is still ridiculously high inflation.

However, many economists are actually saying they are seeing inflation leveling out. We aren't yet seeing that happen with the CPI numbers because we are still looking at year-over-year comparables before inflation got out of control.

The true sign that inflation has slowed, or is still climbing, will be in 2023 when we see year-over-year comps comparing current inflation measures with the elevated inflation we began seeing in early 2022. Continue reading "The Thanksgiving Rally Should Not Be Trusted"