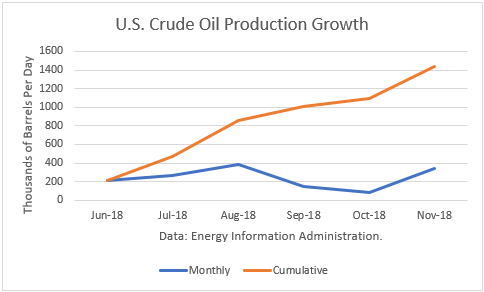

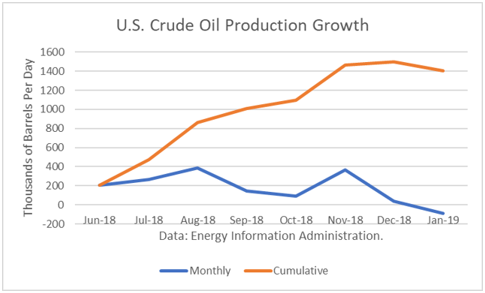

The Energy Information Administration reported that January crude oil production averaged 11.871 million barrels per day (mmbd), down 90,000 b/d from December. Despite the drop in January, crude production still rose by a spectacular 1.407 mmbd from June through January, a period when capacity takeaway constraints had been expected to slow down the growth in Texas.

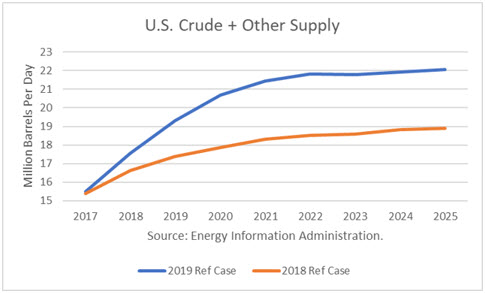

The year-over-year gains have been especially impressive with the January figure being 1.876 mmbd. And this number only includes crude oil. Other supplies (liquids) that are part of the petroleum supply add to that. For January, that additional gain is about 6,950 b/d. Continue reading "U.S. Crude Production In January Displays A Seasonal Lull"