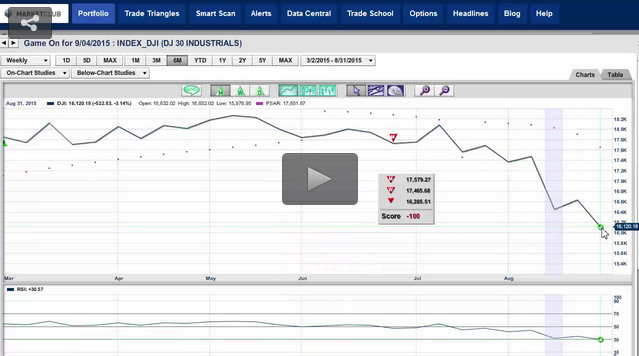

There's no doubt that the dramatic 800 point rally we have seen the past three days is practically unprecedented, but did it change the major trend of the market?

The simple answer is no, the longer-term trend for the equity markets at the moment remains negative. But please don't misunderstand what I'm saying, I was as surprised as anybody at the velocity of the rally which exceeded the Fibonacci retracement levels I discussed recently.

Today should be an interesting day to say the least, and I doubt seriously that the market can close higher and would expect to see some sort of pullback from the current levels. There is also what I would consider to be a major resistance based on the highs that were hit on Feb. 1st at the 1939 level on the S&P 500. Providing that level holds, we are still basically in a downward trending market, albeit a choppy one.

Gold

The pullback in gold (FOREX:XAUUSDO) appears to be consolidating, which is good given its rapid move to the upside. In an ideal world, I would like to see gold continue to consolidate around the $1200 level before once again moving higher. I still believe that gold has broken the back of its four-year bear trend and has now embarked on a long-term bullish trend that could take it to the year 2020. Be sure to watch the Trade Triangles for signals that gold has once again embarked on an upward move. Continue reading "Bull Market Or Bear Market, Which Is It?"