Last Thursday, the dollar rallied, reaching a two-month high versus major currencies, a day after U.S. Federal Reserve shocked markets by projecting a hike in interest rates and an earlier end to emergency bond-buying.

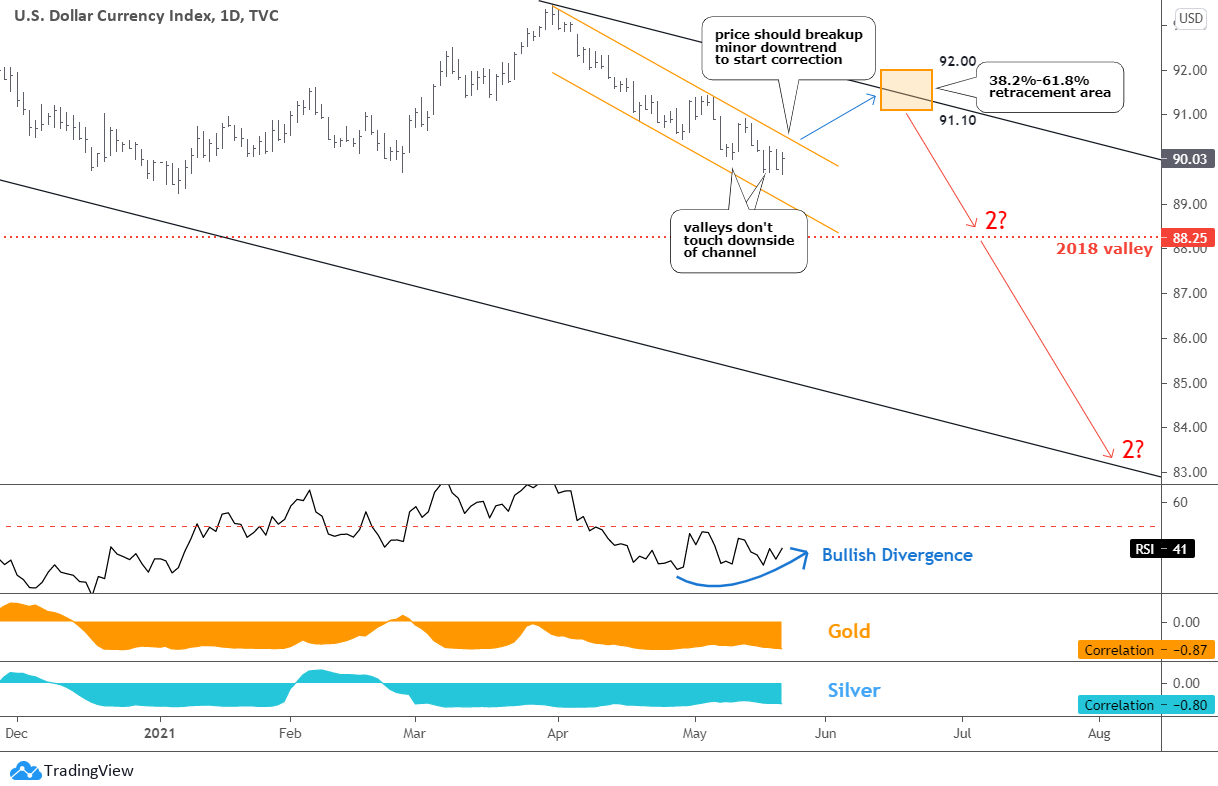

The price broke above the black dotted trendline resistance, which does not look like a minor correction. Instead, I think this is an extension of a large retracement of the entire move down that started in March of 2020.

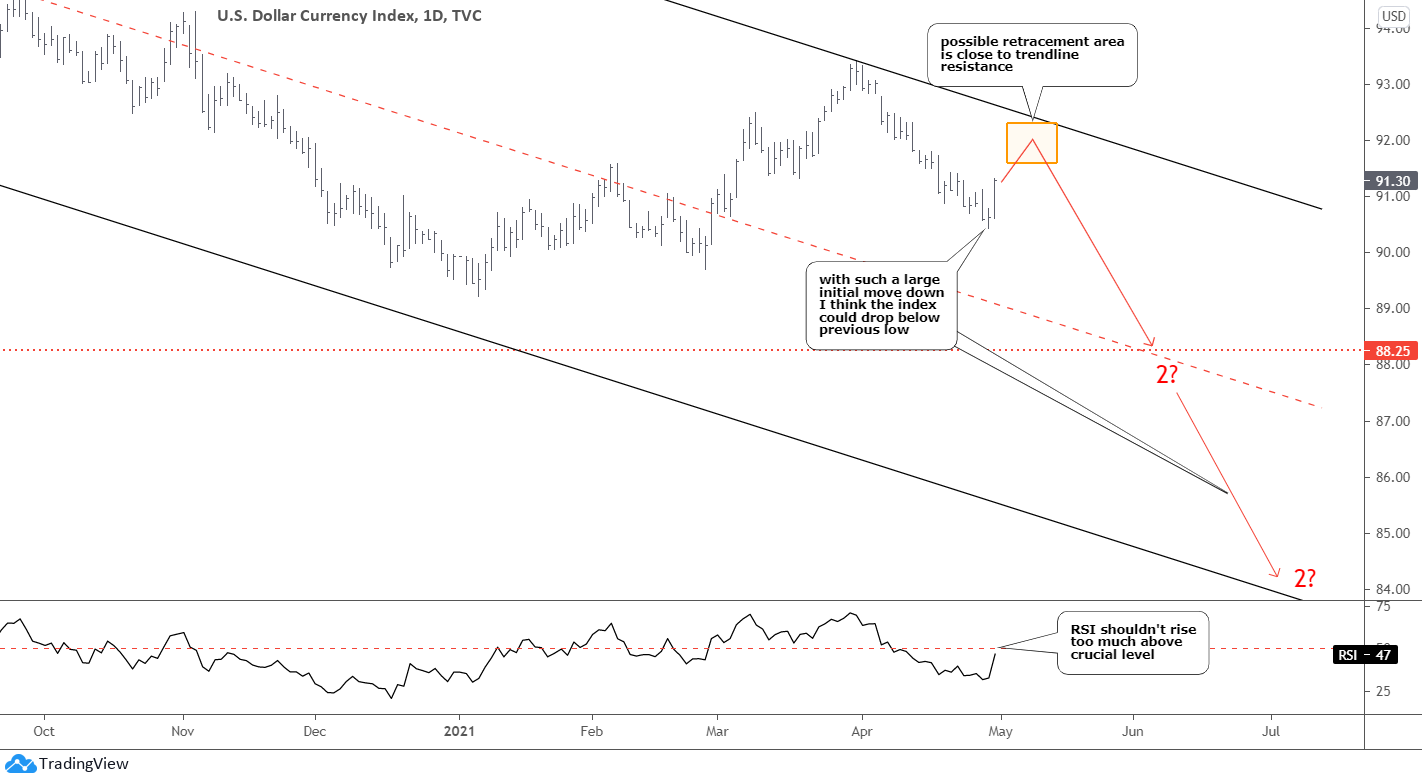

The market could build the second leg of this large consolidation marked with an orange color. I highlighted the last leg with a green zigzag to the upside. The current leg up could repeat the same two-movement structure, so I built the orange zigzag. The first move within a second leg up could be over. I expect the upcoming pullback to retest the broken trendline resistance. After that, the retracement could resume and hit the top of the first leg at 93.4. Continue reading "Gold & Silver: Fed Boosted The Dollar"