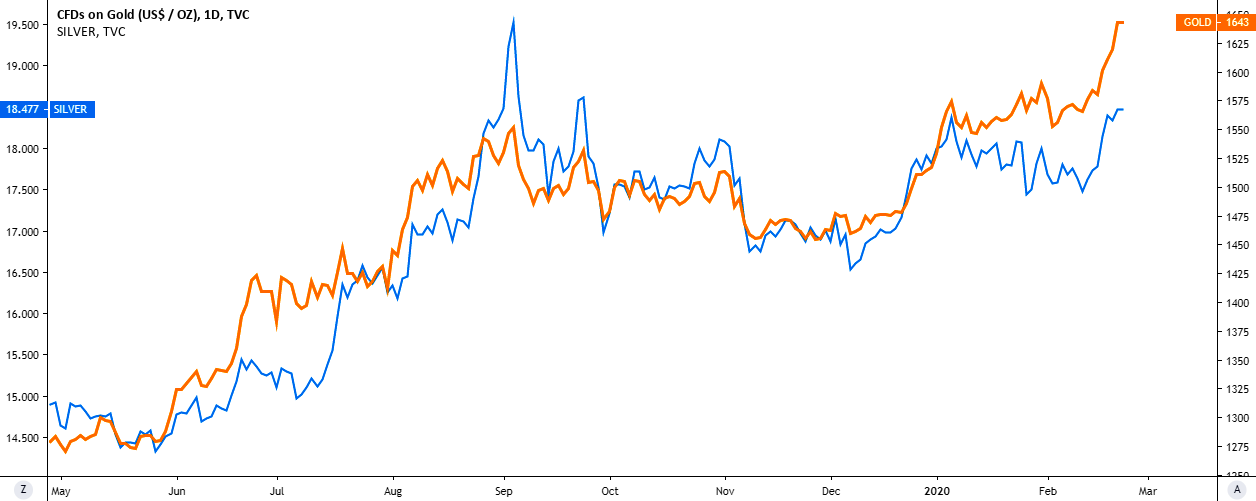

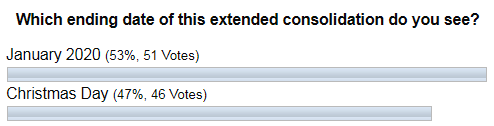

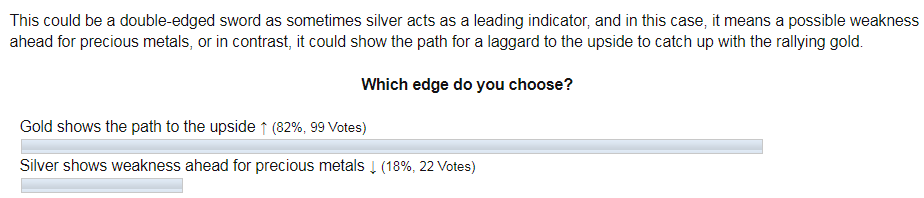

Last week I showed you the chart where gold and silver were compared. The latter was in a worrisome lag behind the shining gold. I think most of us got tired to see if the white metal could update at least the top, that was hit last September amid gold striking one target after another reaching a 7-year maximum. Then I asked you to share your opinion as this alarming signal could be a double-edged sword. Below are your bets about it.

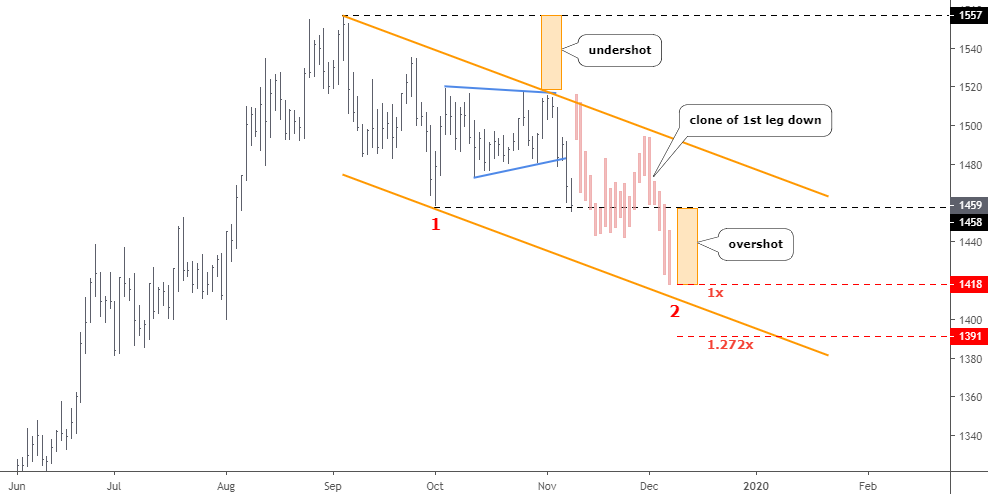

The majority picked the optimistic option of gold, leading the silver to the upside. The opposite came true last week as silver plummeted deep with a minus 14% off the week’s top dragging gold down; the latter lost almost an 8% off the weekly maximum. But before that, gold managed to reach target #4 at the start of last week!

What’s next for silver? Continue reading "Silver Has Three Options To Go"