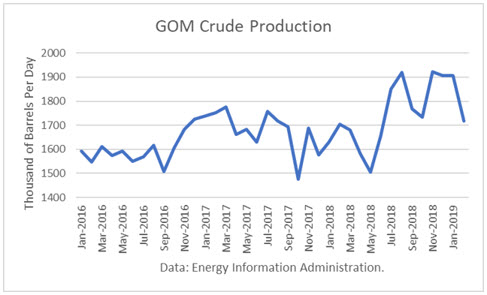

The Energy Information Administration reported that February crude oil production averaged a surprising 11.683 million barrels per day (mmbd), down 187,000 b/d from January. The drop was totally the result of unscheduled maintenance in the Gulf of Mexico (GOM), which averaged 1.719 mmbd. Production had been over 1.9 mmbd in November through January.

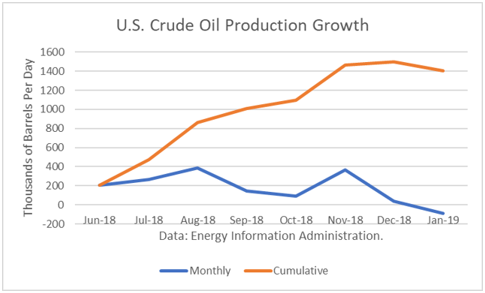

Despite drops in January and February, crude production still rose by a spectacular 1.219 mmbd from June through February, a period when capacity takeaway constraints had been expected to slow down the growth in Texas.

Production in Texas rose by 69,000 b/d to a record 4.890 mmbd. That was nearly offset by a decline in North Dakota of 64,000 b/d due to seasonal factors. Continue reading "U.S. Crude Production In February Reflects Unscheduled GOM Maintenance"