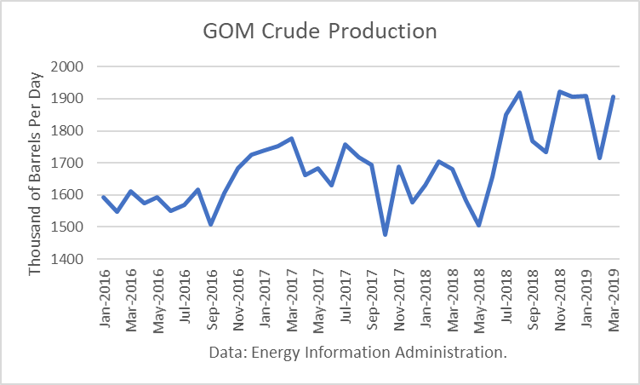

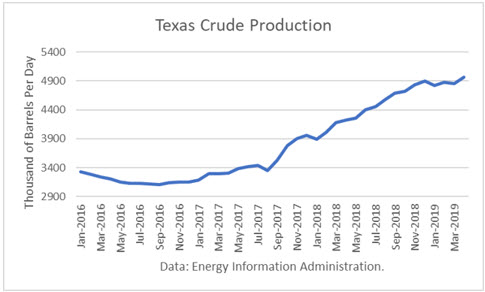

The Energy Information Administration reported that April crude oil production averaged 12.162 million barrels per day (mmbd), up 257,000 b/d from March. The rise resulted from a 107,000 b/d increase in Texas, a 77,000 b/d increase in the Gulf of Mexico (GOM), a 32,000 b/d increase in Oklahoma, a 14,000 b/d increase in Colorado, and a 13,000 b/d increase in Wyoming.

A pause in the growth rate in Texas had been expected due to pipeline constraints, which are expected to be alleviated in the second half of 2019 and the first half of 2020. Nonetheless, crude production set yet another record high in April.

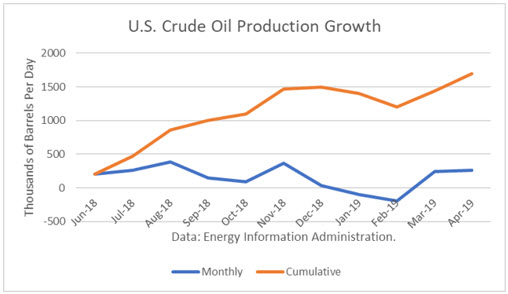

The year-over-year gains have been especially impressive with the April figure being 1.687 mmbd. And this number only includes crude oil. Other supplies (liquids) that are part of the petroleum supply add to that. For April, that additional gain is about 630,000 b/d. Continue reading "U.S. Crude Production Surges In April"