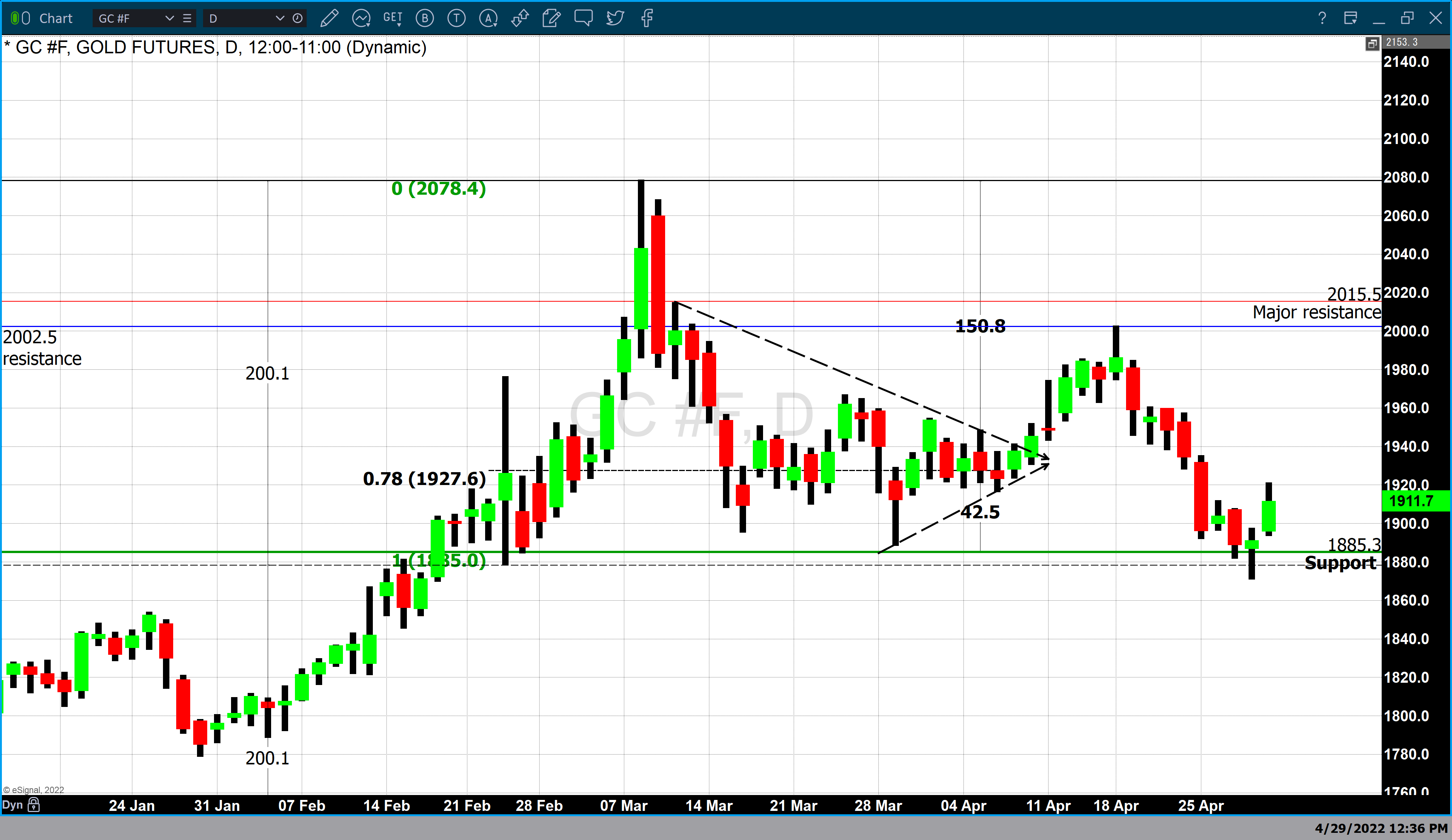

June 2022 gold futures opened Friday morning at $1895.80, far above Thursday’s low of $1871. Trading to a high of $1921.30 and settled in New York up 1.1% at $1911.70. However, on Fridays, Globex trading remains open until 6 PM EDT before closing for the weekend. As of 5:10 EDT, gold has moved back below $1900 and is currently fixed at $1896.90, a net gain of $5.60 or 0.30% in after-hours trading.

The tremendous price swings evident in gold over the last couple of days likely resulted from multiple factors influencing gold prices. Investors continue to focus on next week’s FOMC meeting. It is widely anticipated that the Fed will enact a .50 percent interest rate hike which will go into effect at the end of next week’s meeting. Concurrently it is widely believed that the Federal Reserve will begin to reduce its balance sheet assets over the next three years. Economists polled by Bloomberg news believe that the Federal Reserve will reduce its balance sheet from the current level of $8.8 trillion to $6.4 trillion by the conclusion of 2024. Continue reading "Gold Bounces But Couldn't Hold Friday's Highs"