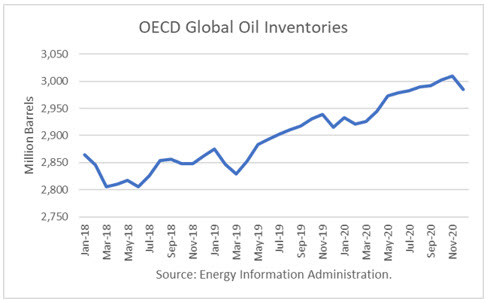

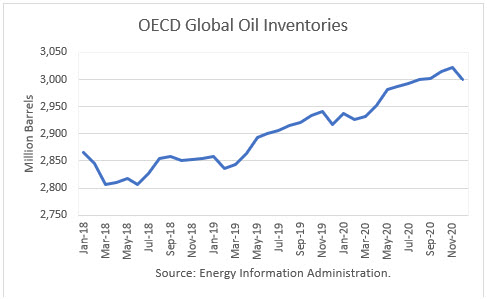

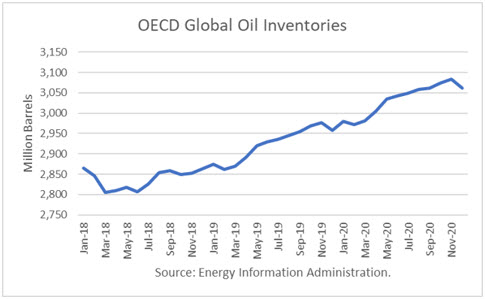

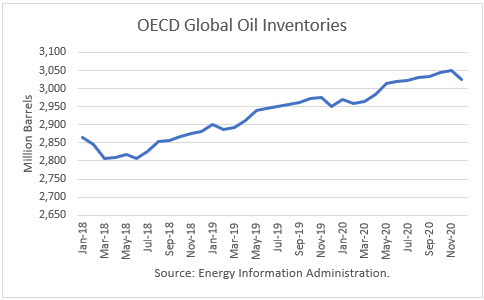

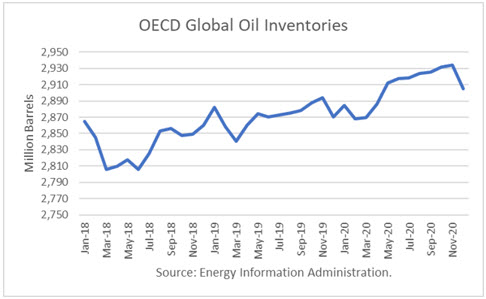

The Energy Information Administration released its Short-Term Energy Outlook for May, and it shows that OECD oil inventories likely bottomed last June at 2.806 billion barrels. It estimated that stocks rose by 20 million barrels in April to 2.860 billion, 51 million barrels higher than a year ago.

Throughout the balance of 2019, OECD inventories are expected to rise modestly. At year-end, EIA projects stocks at 2.870 million barrels, 11 million more than at the end of 2018.

For 2020, EIA projects that stocks will build another 35 million barrels to end the year at 2.905 billion. The non-extension of waivers to Iran’s sanctions implies lower OPEC output for the period, and this factor has lowered the EIA’s stock forecast materially.

Oil Price Implications

I updated my linear regression between OECD oil inventories and WTI crude oil prices for the period 2010 through 2018. As expected, there are periods where the price deviates greatly from the regression model. But overall, the model provides a reasonably high r-square result of 80 percent. Continue reading "World Oil Supply And Price Outlook, May 2019"