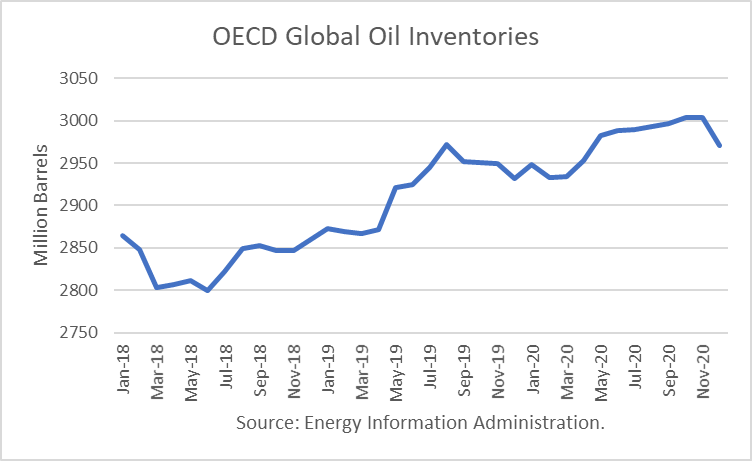

Citi is the latest to revise its estimates of the demand destruction from COVID-19. It said that it now believes inventories of crude oil could grow to 2 million barrels per day in February alone, which would put “even more sustained pressure on prices.” A week ago, the firm’s thought the potential build would be over one million barrels per day for the quarter.

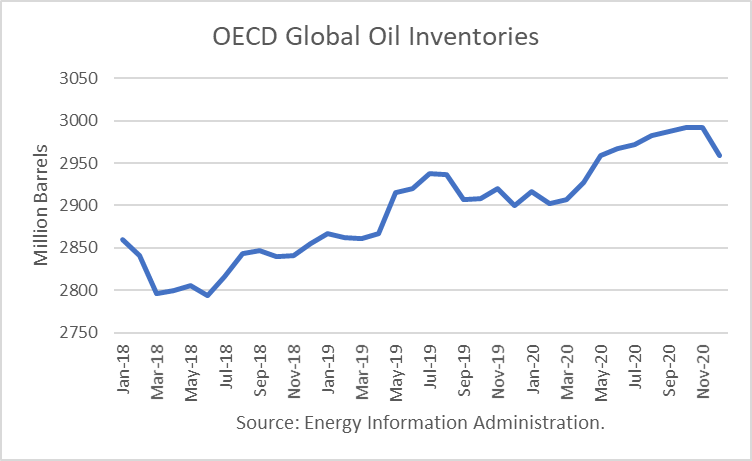

Numerous sources have estimated China’s demand for crude had dropped between two and three million barrels per day since petroleum product consumption had dropped, and the profitability of running refineries had plummeted. But Goldman Sachs (GS) subsequently revised its estimate last week, that they now expect “a cumulative global stock build of 180 million barrels in 1H20, four times its pre-virus forecast.”

The Goldman forecast is based in part on an estimated hit in China’s crude oil demand of 4 million barrels per day. Goldman assumes that OPEC+ will deepen its cuts in 2Q by about 500,000 b/d.

OPEC’s Joint Technical Committee (“JTC”) met from February 4 to 6th and recommended “a further adjustment in production until the end of the second quarter of 2020” and “extending the current production adjustments until the end of 2020.” The cut would be an additional 600,000 b/d on top of the cuts announced in December.

But Russian Energy Minister Alexander Novak told reporters: Continue reading "$50 Crude Oil Not Likely To Hold"