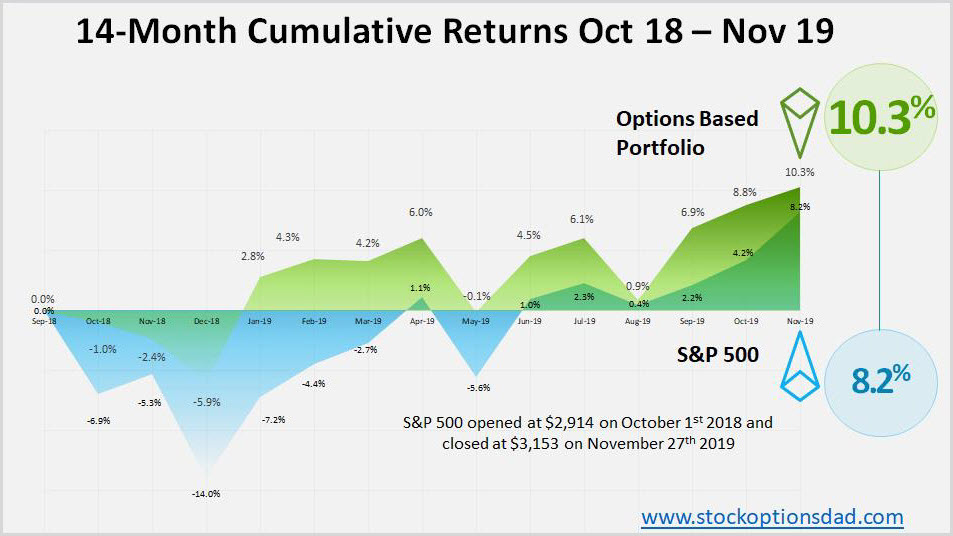

Impeachment proceedings, U.S.-China trade war, Federal Reserve actions, etc., dominate the headlines and move markets in lock-step. The broader indices are at all-time highs and continue to set new high after new high despite the aforementioned variables. The markets have been on a steady rise for months without much resistance, and overall volatility remains low, indicating that market participants have become overly confident and complacent. The S&P 500 has had a banner year in 2019, posting a year-to-date return of over 25% through mid-December. A “blow-off” rally may be underway at this market juncture, and locking-in portfolio gains while mitigating risk is prudent. An options-based portfolio can offer a superior method to constantly locking-in gains while mitigating risk in these frothy market conditions. Over the previous 15 months through the bear market of Q4 2018 and the bull market of 2019, an options-based portfolio has returned 11.6% compared to the S&P 500 return of 8.7%. These returns have been accomplished with an 87% win rate while having the flexibility to hold ~50% of my portfolio in cash. An options portfolio enables optimal risk mitigation and realization of profits on a continual basis, especially important during market euphoria conditions.

Protecting Market Gains

An options-based approach is much like an insurance company where you sell insurance policies and collect premium income at a level that maximizes a statistical edge to your benefit. This strategy mitigates risk and circumvents drastic market moves. Selling options and collecting premium income in a high-probability manner generates consistent income for steady portfolio appreciation in both bear and bull market conditions. This is all done without predicting which way the market will move. Primarily sticking with dividend-paying large-cap stocks across a diversity of tickers that are liquid in the options market is a great way to generate superior returns with less volatility over the long-term.

Over the past ~15 months, 349 trades have been made with a win rate of 87% and a premium capture of 58% across 70 different tickers. When stacked up against the S&P 500, the options strategy generated a return of 11.6% compared to the S&P 500 index which returned 8.7% over the same period. Options are a bet on where stocks won’t go, not where they will go, where high probability options trading thrives in both bear and bull markets (Figures 1 and 2). Continue reading "Protect Your Portfolio Gains In A Euphoric Market"