Options trading, at its core, is defining risk, leveraging a minimal amount of capital, and maximizing return on investment. Options trading in combination with broad-based index funds and cash-on-hand provides portfolio agility in the face of market corrections and volatility expansion. Although options trading provides a margin of downside protection and a statistical edge, no portfolio is completely immune from sharp double-digit declines when a correction occurs. A liquidity position provides portfolio agility to contend with and rapidly adjust when faced with extreme market conditions such as the September market correction.

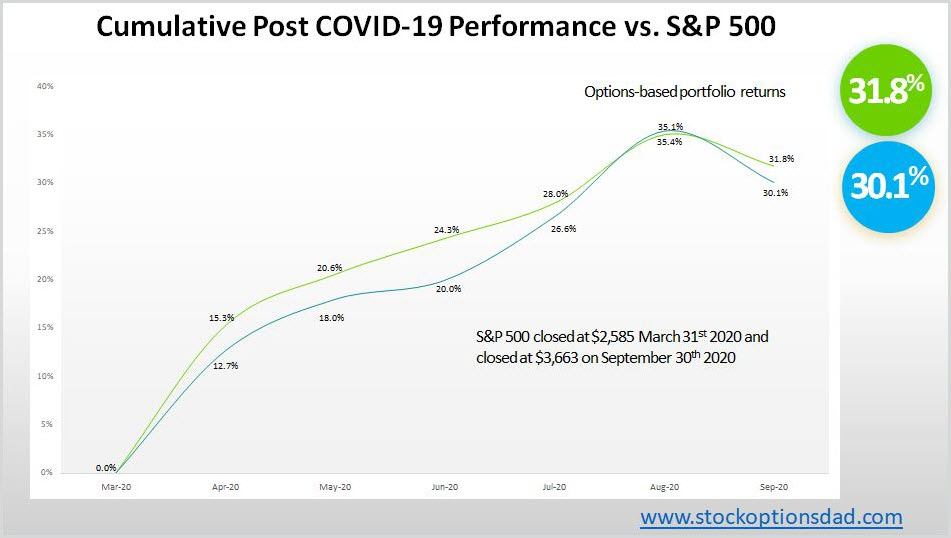

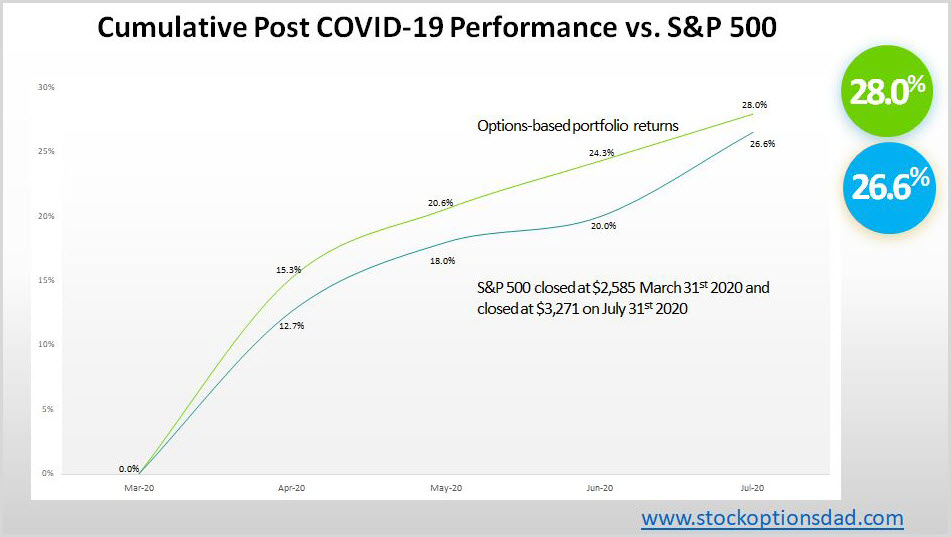

An agile options based portfolio is essential to navigate pockets of volatility. The recent September correction was a prime example of why maintaining liquidity is one of the many keys to an effective long term options strategy. Over the past six months (May, June, July, August, September, and thus far in October), 127 trades were placed and closed. An options win rate of 98% was achieved with an average ROI per trade of 7.4% and an overall option premium capture of 91% while outperforming the broader market despite the September downturn. Along with these metrics, three losses were suffered in September. Analyzing these three losses via self-reflecting and learning will enable traders to make positive future adjustments to their trading strategy.

Despite September Sell-Off – Positive Returns

Since March, the September sell-off was the worst technology rout, while the Dow and S&P 500 posted four-week losing streaks, their longest losing stretches since August 2019. The Nasdaq had its first weekly gain in four weeks at the tail end of September. All the major indices sold off double-digits and into correction territory throughout September. This recent September correction provides a great opportunity to demonstrate the durability and resiliency of an options-based portfolio. Continue reading "98% Options Win Rate Despite September Correction"