Wall Street capped off one of the most volatile years in history. The Dow Jones and S&P 500 ended the year at all-time highs, posting returns of 16.3% and 7.3%, respectively, for 2020. At the same time, the Nasdaq posted a return of 43.6% for the year. These unprecedented returns were achieved despite the S&P 500 nosediving over 30% earlier in the year due to the coronavirus pandemic sweeping the world. In this market environment harnessing options can allow traders to define risk, leverage a minimal amount of capital, and maximize returns.

All-time highs have been reached with the confluence of election certainty, improving vaccine prospects across the globe, and massive stimulus out of Washington. These positive developments have been priced into the markets. The broader indices are richly valued as measured by virtually any historical metric via stretched valuations, options put/call ratios, broad participation above 200-day moving averages, and elevated P/E ratios. Collectively, these may be potential warning signs of near-term pressures. Heeding these frothy market conditions via risk mitigation may be best served with risk-defined options trading.

Options: Margin of Protection and Defining Risk

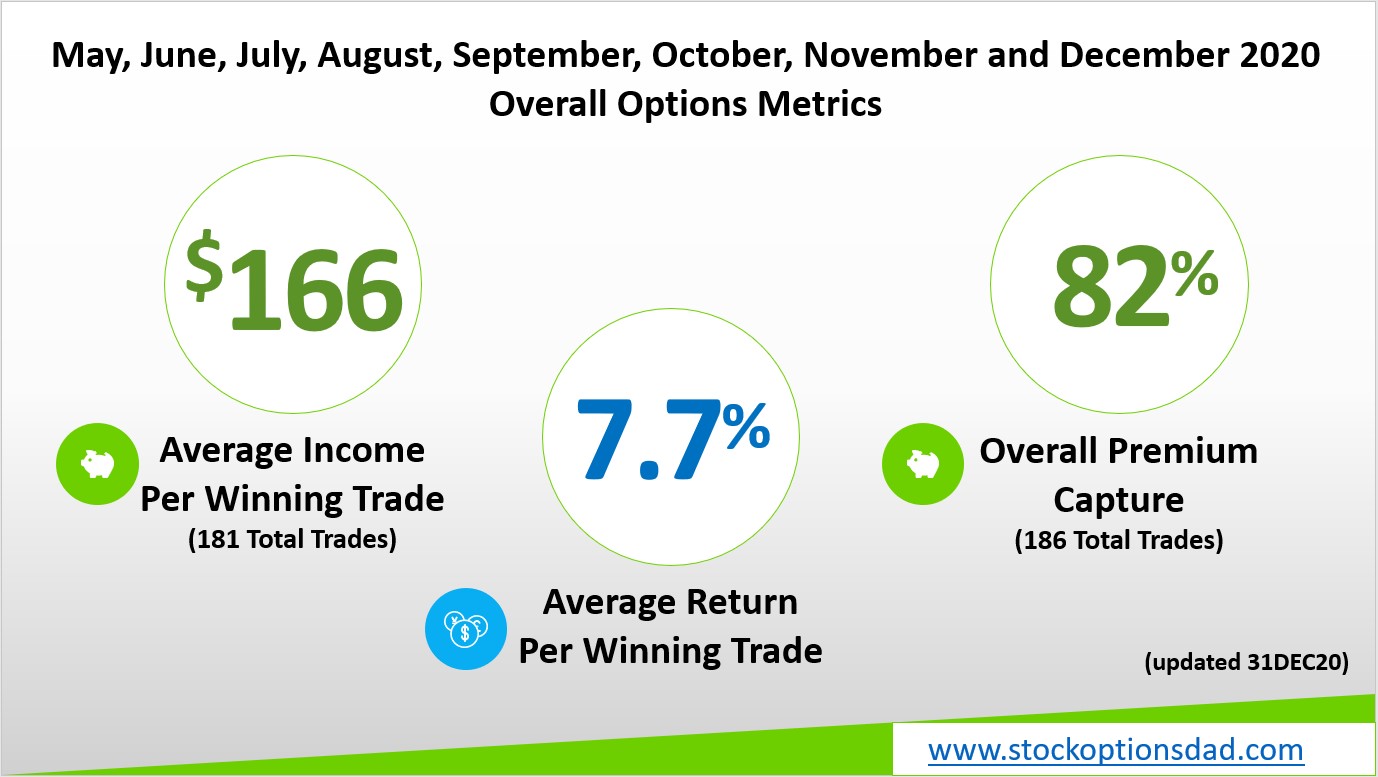

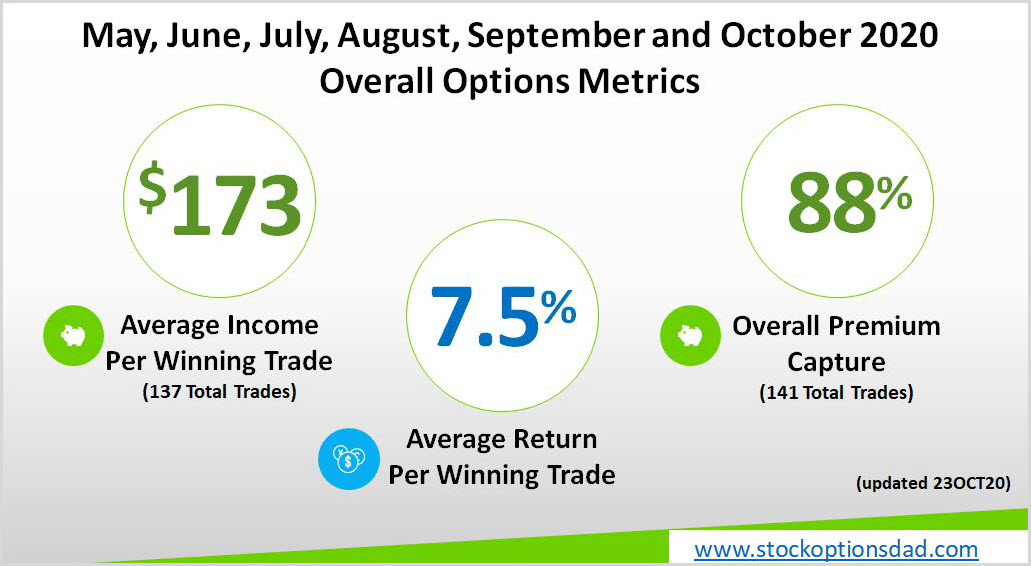

Harnessing options in frothy markets allows one to define risk, leverage a minimal amount of capital, and maximize returns. Options can be structured to allow a margin of downside and/or upside stock movement while collecting income in the process. In these richly valued markets, allowing a margin of downside and/or upside stock movement may be a great strategy to heed potential market volatility. Continue reading "Leveraging Options To Navigate Frothy Markets"