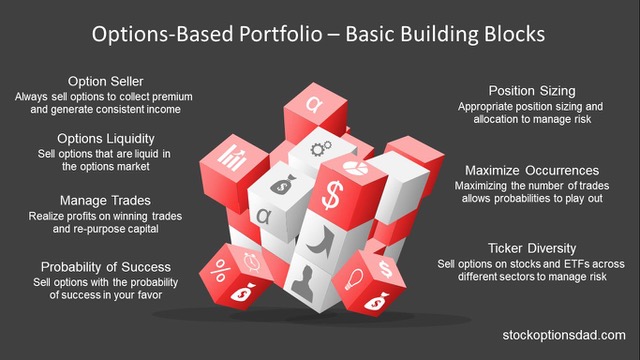

Over the past 12 months, I’ve managed an options-based portfolio and demonstrated how this approach can offer a superior alternative to traditional stock picking. An options-based approach is very similar to running your portfolio like a business where you manage risk and take profits. Alternatively, an options-based approach is much like an insurance company. You sell as many policies as possible to collect as much premium income as possible with a premium cost level that maximizes a statistical edge to your benefit.

An option-based strategy mitigates risk and circumvents drastic market moves. Selling options and collecting premium income in a high-probability manner generates consistent income for steady portfolio appreciation in bear and bull market conditions. This is all done without predicting which way the market will move. Sticking with dividend-paying large-cap stocks across a diversity of tickers that are liquid in the options market is a great way to generate superior returns with less volatility over the long term.

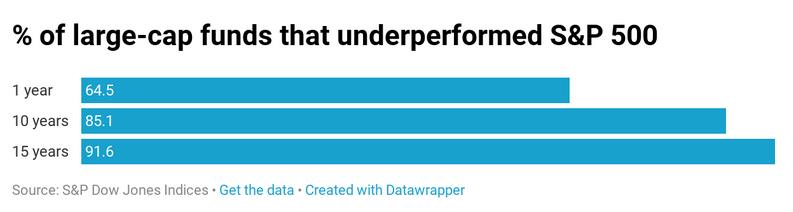

Over the past 12 months, 298 trades have been made with a win rate of 86% and a premium capture of 57% across 69 different tickers. When stacked up against the S&P 500, the options strategy generated a return of 6.9% compared to the S&P 500 index, which returned 2.2% over the same period. Options are a bet on where stocks won’t go, not where they will go, where high probability options trading thrives in both bear and bull markets.

Figure 1 – Basic principles and building blocks of an options-based portfolio

Continue reading "6.9% Options Portfolio Return vs. 2.2% S&P 500 Return"