TD Ameritrade, Fidelity, Charles Schwab, and E-Trade are following in Robinhood's footsteps and offering commission-free trading on all stocks, ETFs, and options trading! This presents an options trader’s paradise and serves as a great time to start trading options as these commissions are no longer cutting into your profit margins. This is vital since maximizing the number of trade occurrences is one of the many reasons why options trading is so effective over the long term. Over the past 14 months, an options-based portfolio demonstrated the effectiveness of this strategy against the traditional stock-picking approach.

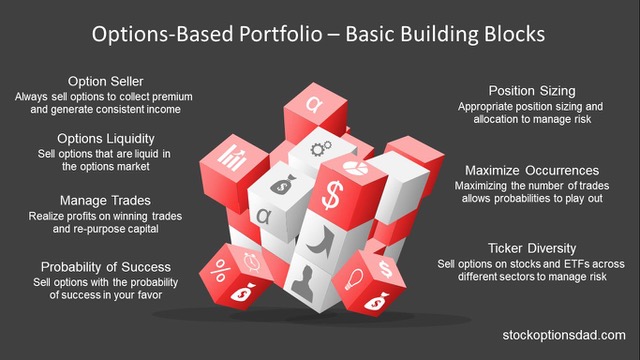

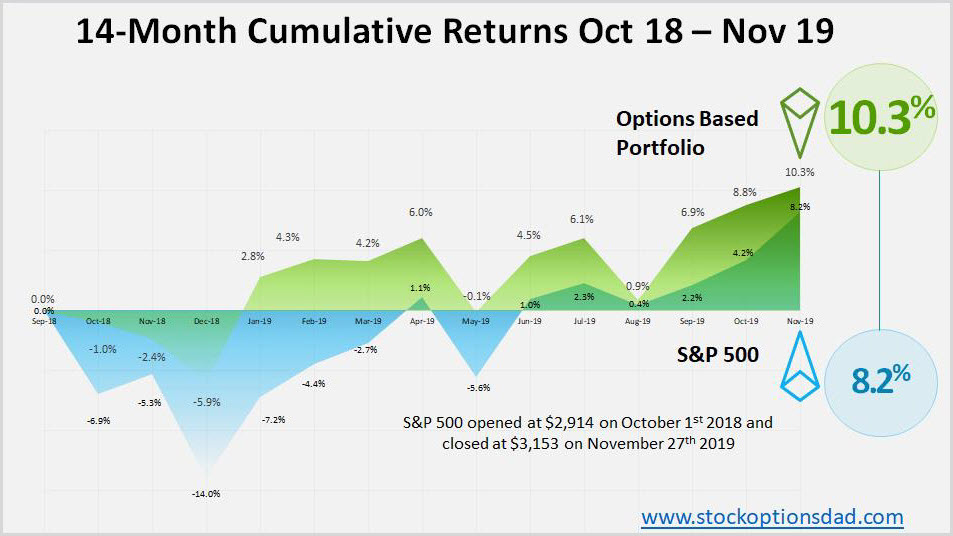

Primarily sticking with dividend-paying large-cap stocks across a diversity of tickers that are liquid in the options market is a great way to generate superior returns with less volatility over the long term. Over the past 14 months, 343 trades have been made with a win rate of 87% and a premium capture of 58% across 70 different tickers. Moreover, when stacked up against the S&P 500, an options strategy generated a return of 10.3% compared to the S&P 500 index, which returned 8.2% over the same period. These returns demonstrate the resilience of these high-risk options trading in both bear and bull markets (Figures 1 and 2).

Figure 1 – 14-month cumulative returns of an options-based strategy compared to the S&P 500 returns over the same time period

Continue reading "Brokers Go Commission Free - Options Paradise"