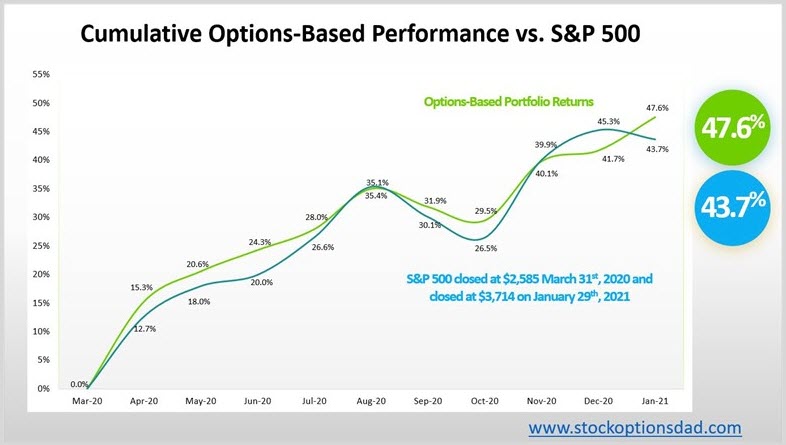

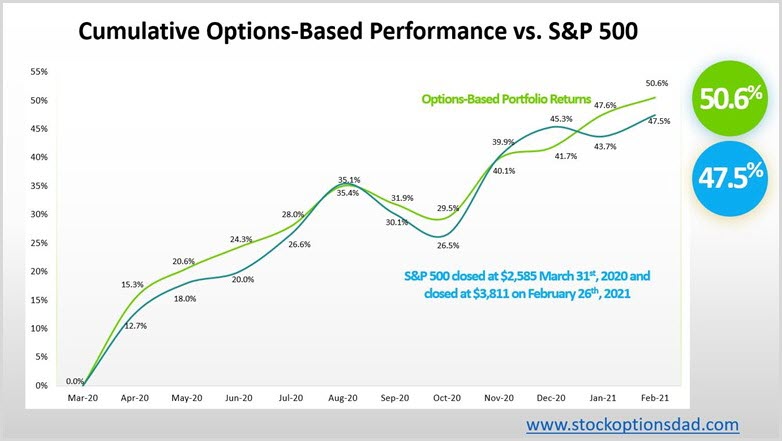

An agile options-based approach is essential to navigating these choppy markets that we have witnessed thus far in 2021. Generating consistent monthly income while defining risk, leveraging a minimal amount of capital, and maximizing return on capital is the core of options trading. Options enable smooth and consistent portfolio appreciation without guessing which way the market will move. Options allow one to generate consistent monthly income in a high probability manner in all market scenarios. Over the past 10-plus months (May 2020 – March 2021), 225 trades were placed and closed. A win rate of 98% was achieved with an average ROI per winning trade of 7.5% and an overall option premium capture of 84% while outperforming the S&P 500. The performance of an options-based portfolio demonstrates the durability and resiliency of options trading to drive portfolio results with substantially less risk. This approach circumvented the September 2020, October 2020, and January 2021 sell-offs while outperforming the S&P 500, posting returns of 50.6% and 47.5%, respectively (Figures 1, 2, and 3).

Figure 1 – Overall options-based performance compared to the S&P 500 from May 2020 – February 2021 Continue reading "Options: Outperformance Despite Choppy Markets"