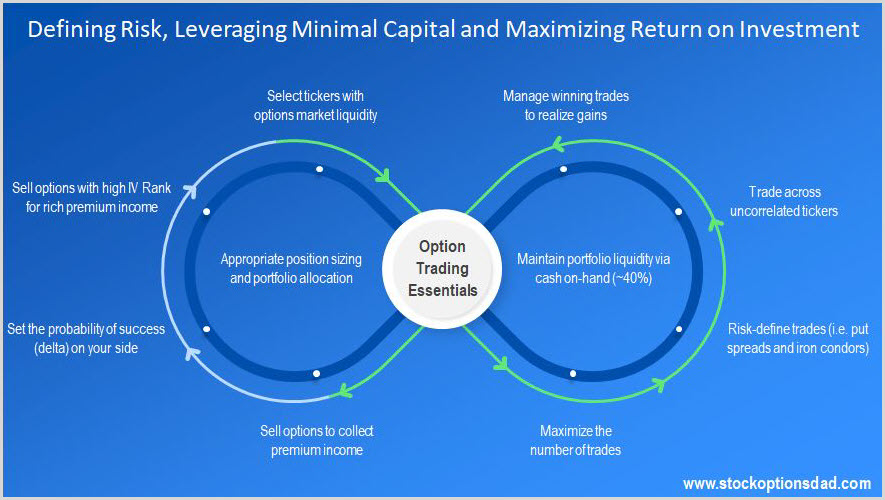

Leveraging a minimal amount of capital, mitigating risk, and maximizing returns is the objective of an options-based portfolio. Options trading can offer the optimal balance between risk and reward while providing a margin of downside protection with a high probability of success. Proper portfolio construction and optimal risk management are essential when engaging in options trading as a means to drive portfolio performance. Key pillars of risk mitigation are rooted in maintaining liquidity, risk-defining trades, staggering options expiration dates, trading across a wide array of uncorrelated tickers, maximizing the number of trades, appropriate position allocation, and selling options to collect premium income. Customizing your option trade structure is another element that can be layered into the overall strategy for long-term success in options trading. A risk-defined custom put spread offers layers of protection, thus optimizing the risk management aspect of an options trade while maximizing return on investment.

Custom Put Spreads: Results

Leveraging a minimal amount of capital and maximizing returns with risk-defined trades optimizes the risk-reward profile. Whether you have a small account or a large account, a defined risk (i.e., custom put spreads) strategy enables you to leverage a minimal amount of capital which opens the door to trading virtually any stock on the market regardless of share price such as Apple (AAPL), Amazon (AMZN), Chipotle (CMG), Facebook (FB), etc. Risk-defined options can easily yield double-digit realized gains over the course of a typical one month contract (Figures 1, 2, and 3).

Figure 1 – Average income per trade of $201, the average return per trade of 7.6% and 98% premium capture over 63 trades in May and June

Continue reading "Options Trading - Custom Put Spreads"