Generating consistent monthly income in a high probability manner in both bear and bull markets is the luxury of options trading. The core of options trading is defining risk, leveraging a minimal amount of capital, and maximizing returns. They enable smooth and consistent portfolio appreciation without guessing which way the market will move. An options-based portfolio performance demonstrates the durability and resiliency of options trading as a means to drive portfolio results.

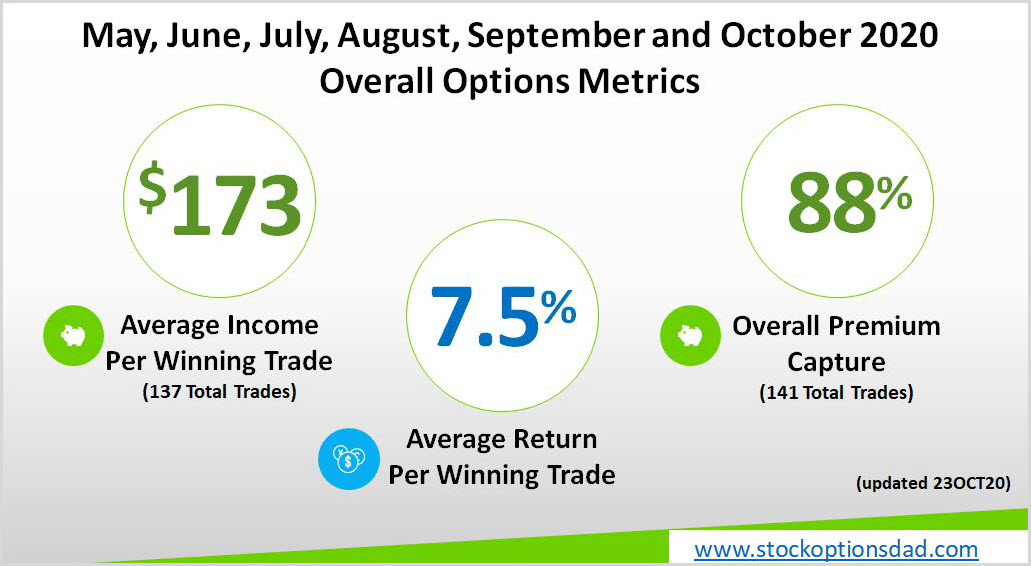

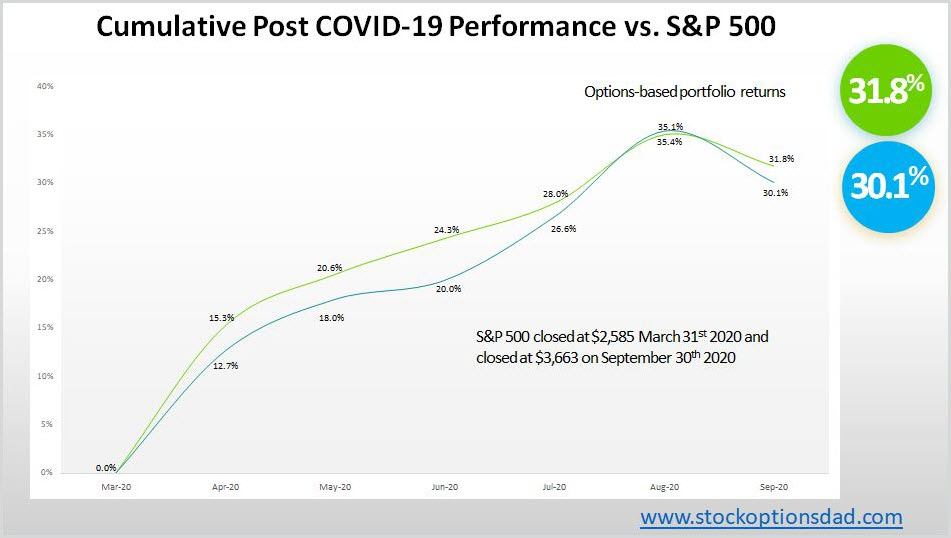

An agile options-based portfolio is essential to navigate pockets of volatility and mitigate market downdrafts. The recent September correction, October nosedive, and election volatility into November are prime examples of why risk management is paramount. Despite the recent market volatility, positive returns in all three market scenarios were generated. Over the past 6-plus months, 171 trades were placed and closed. A win rate of 98% was achieved with an average ROI per trade of 7.6% and an overall option premium capture of 89% while matching returns of the broader market and outperforming during market downswings (Figures 1 and 2).

Figure 1 – Overall option metrics from May 2020 – December 4th, 2020

Continue reading "Options: Generating Consistent Monthly Income"