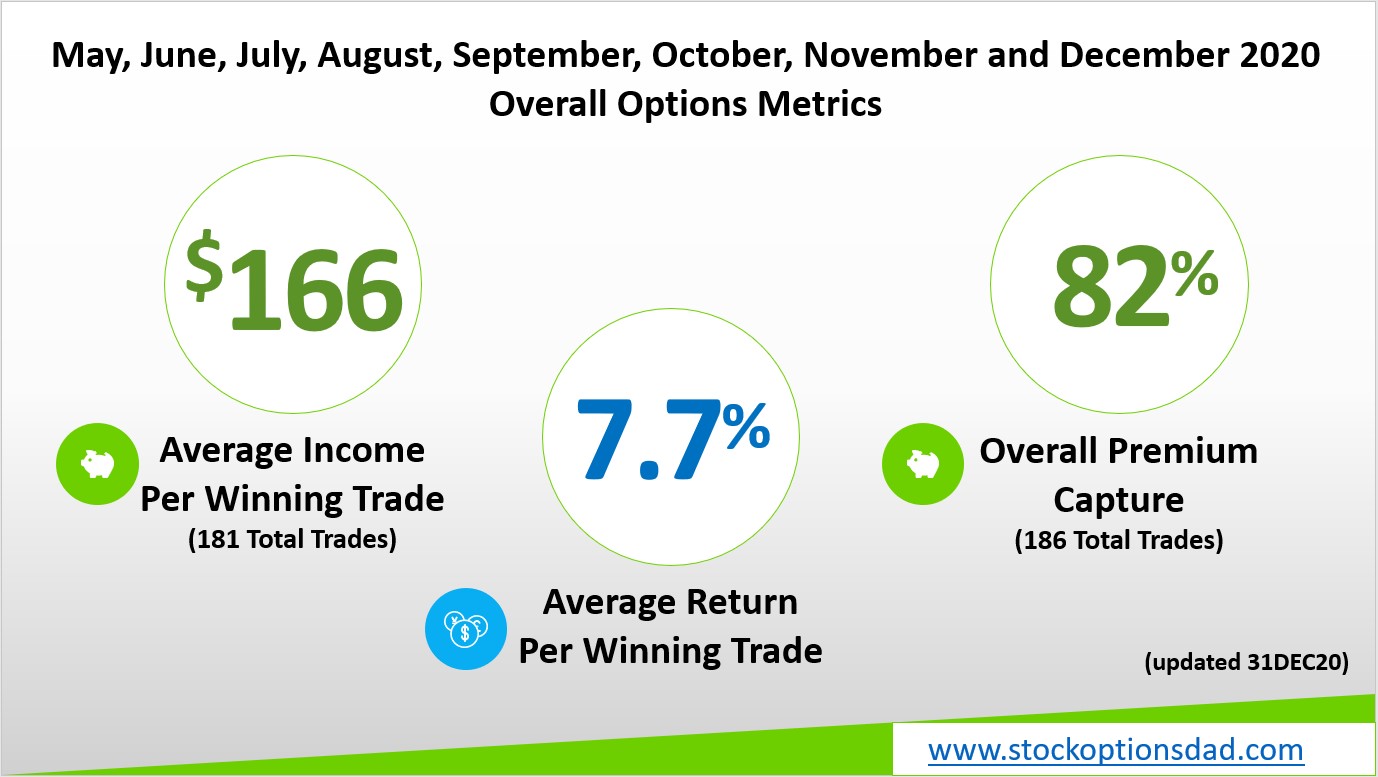

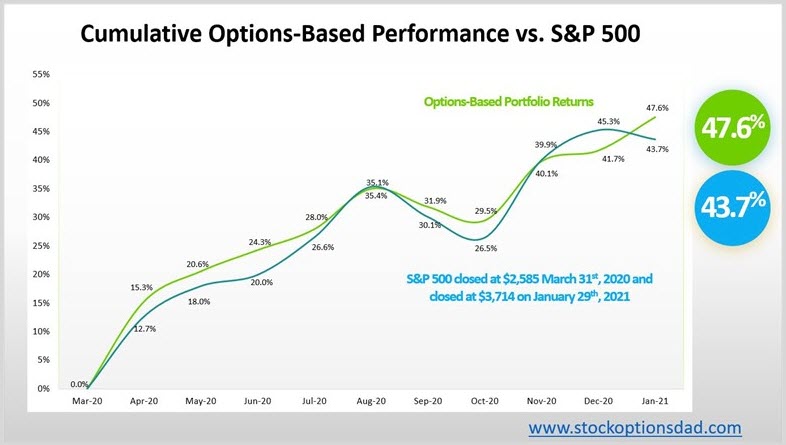

Another positive month for the options-based portfolio despite another negative month for the markets. A positive $3,372 in income was generated for January 2021. Generating consistent monthly income while defining risk, leveraging a minimal amount of capital, and maximizing return on capital is the core of options trading. Options enable smooth and consistent portfolio appreciation without guessing which way the market will move and allow one to generate consistent monthly income in a high probability manner in both bear and bull market scenarios. Over the past 9-plus months (May 2020 – January 2021), 203 trades were placed and closed. A win rate of 98% was achieved with an average ROI per winning trade of 7.8% and an overall option premium capture of 83% while outperforming the S&P 500. The performance of an options-based portfolio demonstrates the durability and resiliency of options trading to drive portfolio results with substantially less risk. The options-based approach circumvented the September, October, and January sell-offs while outperforming the S&P 500, posting returns of 47.6% and 43.7%, respectively (Figures 1, 2, and 3).

Figure 1 – Overall options-based performance compared to the S&P 500 from May 2020 – January 31st, 2021

Continue reading "Options: Positive Returns Despite Negative Market Returns"