Corrections in Gold and Gold Stocks are completely normal in an inflationary macro market phase.

Every week I notice the agony ratcheting up incrementally. While the rest of the casino takes off to the speculative heavens, gold sits on its heavy ass and the gold miners go nowhere in a downward-biased perma-correction. Or so it seems. It’s all normal and I’ll explain why.

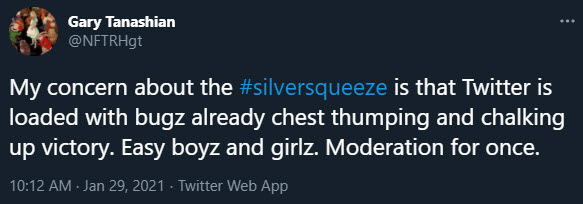

First of all, it is not healthy to be railing against unseen nefarious manipulative interests. That is emotion and emotion has to be kept out of it (and yes, I get as aggravated as the next guy sometimes, but it cannot affect your plan or you will be the victim, the mark). You have to take what the market gives you and roll with it. All markets are manipulated when you consider that the greatest manipulation of all is courtesy of the Federal Reserve, implementing it's MMT (Modern Monetary Theory), err, that is TMM (Total Market Manipulation) toward desired ends.

The primary tool in that manipulation is inflation. The oldest trick in the Fed’s book. But they can only inflate under cover of a deflationary macro and the 2020 COVID-crash made that the story and as yet it’s a condition that keeps on giving license to the inflators. But very likely sometime in 2021, our indicators will signal a failure into another deflationary liquidation or a more intense inflationary problem, neither of which would be positive for the economy. Continue reading "Gold & Gold Stock Corrections Are Normal"