With increasing climate change concerns, rising costs of fossil fuels due to geo-political turbulence and ever-depleting supplies, and growing inclination toward lower operational and maintenance costs, the global automotive industry is fast transitioning toward e-mobility.

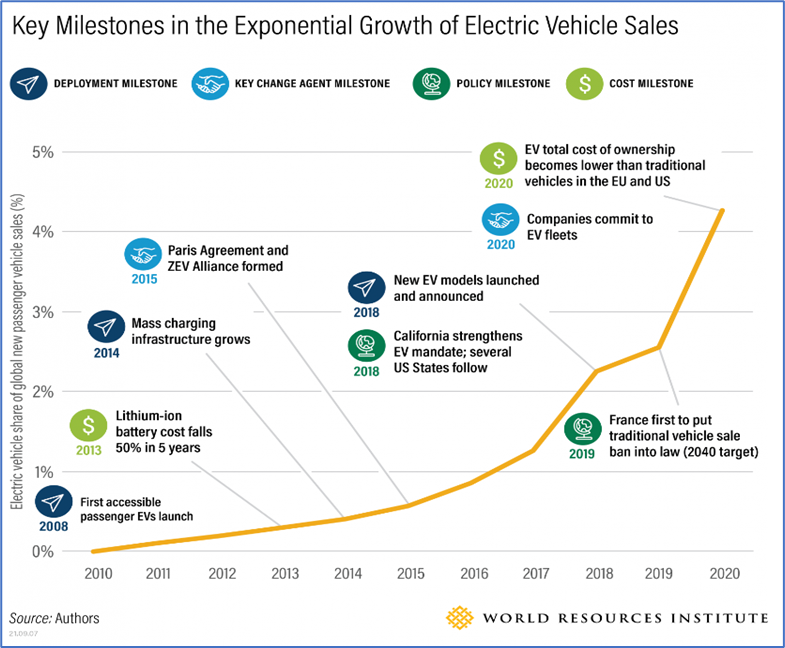

Including electric vehicles, charging networks, infrastructure, and energy storage, the global electric mobility ecosystem is projected to grow at 23.7% CAGR between 2022 and 2029. The following chart illustrates the key milestones in the impressive growth trajectory of electric vehicles.

While high input and borrowing costs amid record-high inflation and an increasing interest rate environment impeding the EV industry’s growth, EVs are expected to keep replacing Internal combustion engine vehicles at an increasing rate each year.

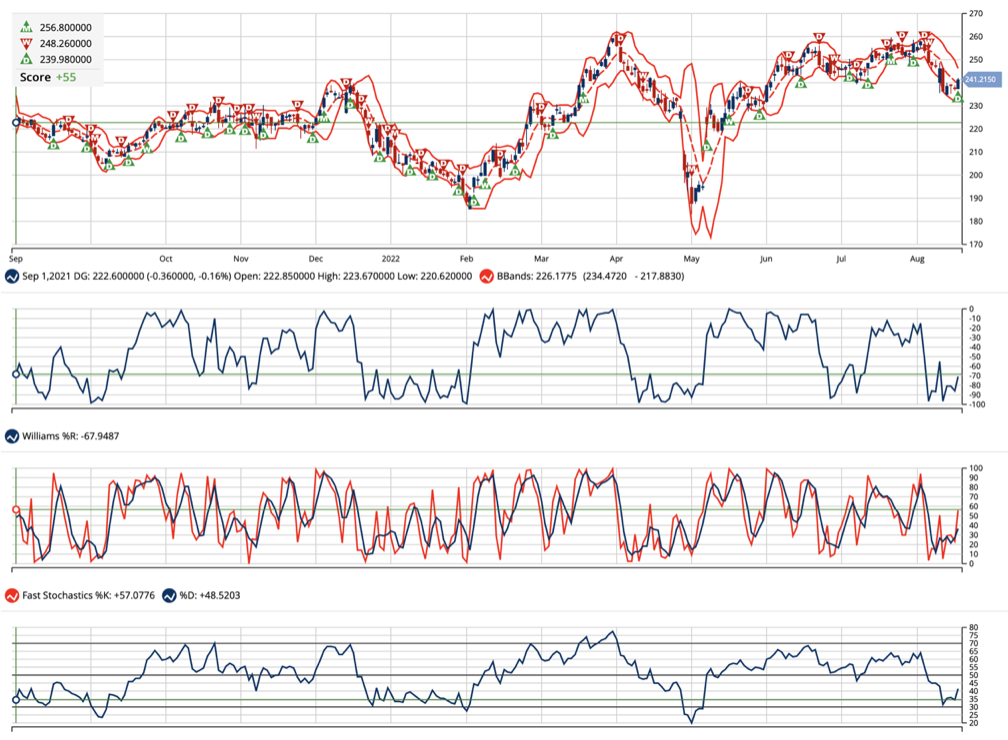

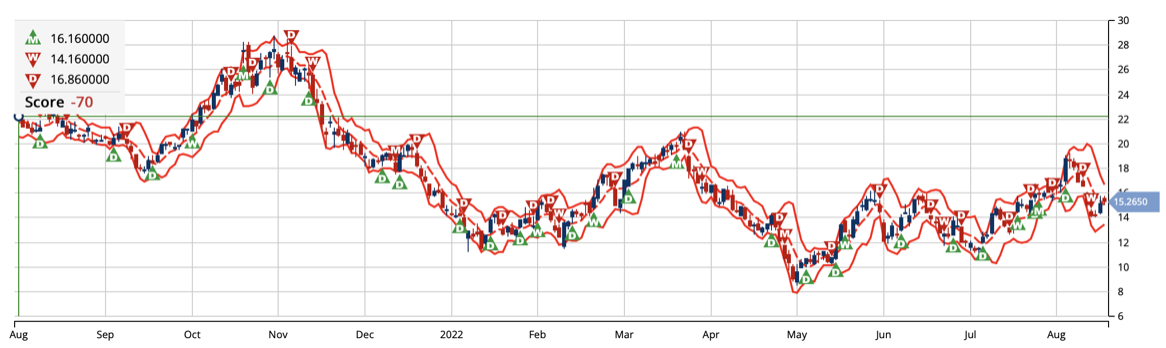

However, since the EV industry is expected to bear the brunt of the macroeconomic headwinds in the near term, investors are advised to exercise caution and not to bottom fish NIO Inc. (NIO) and Blink Charging Co. (BLNK), as some technical indicators point to further downside in these stocks. Continue reading "Don't Fall Victim to These 2 EV Stocks"