Carry trade... if that’s the first time you’ve come across that term you should know that "carry trade" is one of the oldest tricks in the books when it comes to foreign exchange trading. It is based on a very basic gap, specifically, the interest rate gap. The way investors use it to create alpha is by borrowing one currency with a lower interest rate and buying with the borrowed cash a currency with a higher one. The investor's gain is created then by the gap between what the borrower pays on the low yielding currency and what he earns on the high yielding currency. Of course, if the currency you buy appreciates in the process that would be even better.

Investors have been making good (i.e. profitable) use of this technique for years using various currencies. For instance, back in the 1990s and 2000s, investors would borrow the Japanese Yen, then buy the U.S. Dollar or Euro. Or as in the 2009-2010 period, they’d borrow the U.S. Dollar and buy the Euro (of course, back then rates were much higher). Usually, this would create inflows for the higher yielding currencies and as such lead to the currency’s appreciation. But what happens when this rate gap is threatened? As Euro bulls discovered just recently, it can create a meltdown of the trade rather quickly and the trend can reverse course just as fast. So, why am I telling you this? Why the sudden dive into the mechanics of the carry trade? Because just as you are reading those very words, a big carry trade is set to unravel and as it does, the trend it created is set up to reverse as well.

The Aussie Kiwi Carry Trade

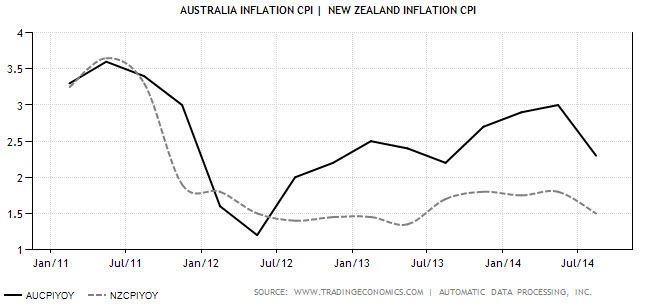

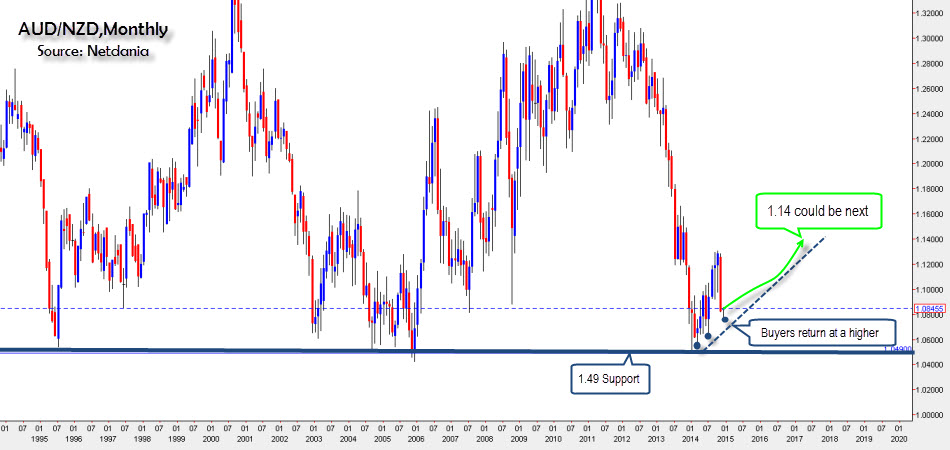

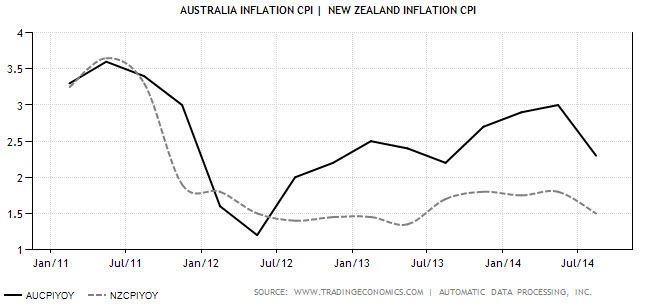

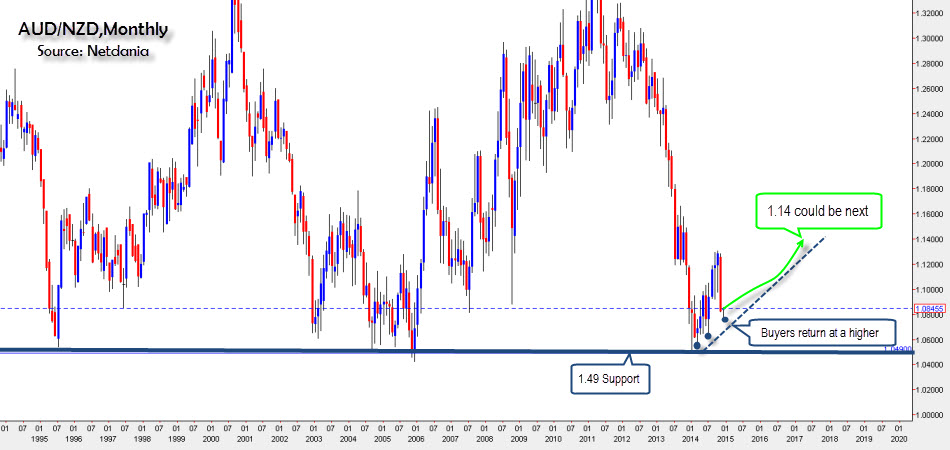

One of most prominent carry trades of the past two years has revolved around the currencies of two neighboring countries, Australia and New Zealand. Ever since China’s economy began slowing and the commodity space began its bearish cycle, the Australian economy has likewise been slowing and, of course, as a result interest rates were cut to prevent the Aussie economy from further deterioration. However, while Australia suffered a slowdown, New Zealand, its smaller neighbor, has been faring well and growing above trend, thanks in large part to a prosperous dairy industry. Naturally, this created an interest rate deferential which is illustrated below and, as you might have guessed, a big carry trade that led the AUD/NZD to an utter collapse of 20.9% until it reached a multi-year low of 1.049. Yet, now as the pair is trading close to its record low, there are tentative signs emerging which suggest a turnaround could be in the making. This could lead the trend to reverse and allow investors to potentially bank on a big rebound of the AUD/NZD. Image courtesy of TradingEconomics.com.

The Trend Unravels

So, why is the trend on the verge of unraveling? In one word: inflation. If Australia had lower interest rates along with a rate of inflation lower than New Zealand’s own, the trend would have no reason to reverse. Australian interest rates would remain low (or else be at risk of dropping lower), while New Zealand would have rising inflationary pressures that would justify higher rates. But that is not the case at all. In fact, Australia’s annual inflation rate is more than double New Zealand’s. Aussie inflation was reported at 2.3% YoY while New Zealand’s inflation stands at a mere 1%, and that is in spite of the one-off effect of a reduction in Australia’s electricity tax that lowered inflation. In other words, while interest rates in Australia are much lower, the inflation rate is much higher, shaking the fundamentals of the trend. This means that while the Reserve Bank of Australia (RBA) has neither the space nor the rationale for easing, the Reserve Bank of New Zealand (RBNZ) has at least one reason to cut rates and none to raise them, leaving the fundamentals of the short AUD/NZD to crumble and open the space for a rebound. Image courtesy of TradingEconomics.com.

Price and Projections

But now, there’s one final question, does the market show signs of a trend reversal in the AUD/NZD? The answer is yes. As seen below, each and every time the pair moved nearer to its record low of 1.049, buyers emerged. In fact, since the beginning of the year, buyers for AUD/NZD seem to reemerge, each time at a higher point, signaling a clear, albeit slow, sentiment shift. However, given that the RBNZ rate decision is set to take place next week and considering that the RBA took a decidedly neutral turn this week, the likelihood of an AUD/NZD trend reversal is on the rise, especially as the RBNZ governor continues, time and again, to point out that the Kiwi Dollar is "unjustifiably high." If that winds up being the case next week as well, that trend reversal could quickly accelerate. And as far as projections go? Looking at the chart, logically, we could be looking at a reversal toward at least 1.14 as this Aussie Kiwi carry trade unravels over the next couple of months.

Look for my post next week.

Best,

Lior Alkalay

INO.com Contributor - Forex

Disclosure: This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.