Being in the semiconductor business is like owning a plantation of Chinese bamboo. Small incremental steps that often seem too insignificant and inconsequential, especially to unsuspecting investment research analysts like us, compound over time to reach an inflection point and give a company’s stock the kind of moonshot like the one that NVIDIA Corporation (NVDA) experienced after its earnings release on May 24.

The Santa Clara-based graphics chip maker has stolen the thunder over the past week by becoming the first semiconductor company to hit a valuation of $1 trillion, albeit briefly, boosted by the interest in AI and its launch of new partnerships.

However, the seeds of this breakout were sown by the company, which went public in 1999 and occasionally flirted with bankruptcy, back in 2006 when the company took the first steps to raise accelerated computing to a whole new level by making its foray into parallel (and consequently faster) computing with the release of a software toolkit called CUDA.

Parallel computing was ideal for artificial neural networks' deep (machine) learning. Hence the kit was first used in AlexNet, a revolutionary AI then. This set off a chain reaction that has propelled the company to the center stage of the AI boom.

Fast-forward to today, and NVDA is reaping the rewards for all that invisible work as its A100 chips, which are powering LLMs like ChatGPT, have become indispensable for Silicon Valley tech giants.

To put things into context, the supercomputer behind OpenAI’s ChatGPT needed 10,000 of Nvidia’s famous chips. With each chip costing $10,000, a single algorithm that’s fast becoming ubiquitous is powered by semiconductors worth $100 million.

Now let’s pivot to the company that put Silicon in Silicon Valley. Intel Corporation (INTC), the pioneer of modern computing, has fallen behind the law attributed to one of its founders, Gordon Moore.

The company, going through a turbulent phase, reported its largest quarterly loss in history in the first three months of 2023, with revenue down 36% and a 133% decline in earnings per share compared to the same period last year. Moreover, its expectations for the second quarter also fell short of analyst expectations.

“We didn’t get into this mud hole because everything was going great,” was the honest assessment by CEO Pat Gelsinger, who also took a pay cut along with other executives as INTC also kicked off cost-cutting measures as it is hustling to catch up to, and hopefully surpass, its more accomplished rivals such as TSMC and Samsung.

However, in its long and eventful history, the company has been here before. The memory chip pioneer, which saw its market share eroding away to oblivion, made a drastic pivot to microprocessors in 1984 at the onset of the PC boom, only to miss the bus on smartphones in 2011 by turning down an early offer from Apple Inc. (AAPL).

Road Ahead

The optimism surrounding NVDA is justified. With the company’s presence in data centers, cloud computing, and AI, its chips are making their way into self-driving cars, engines that enable the creation of digital twins with omniverse that could be used to run simulations and train AI algorithms for various applications.

Even its previously unsuccessful Tegra processors have found a new lease of life in logistics robots and driverless cars.

However, the seeds of chaos are sown at times of unbridled optimism and willful suspension of disbelief. At the risk of spoiling the mood, at the end of the day, the company is primarily a chip designer that is committed to remaining a fabless chip designer to keep capital expenditure low.

Hence, NVDA faces risks of backward integration by companies such as Apple Inc. (AAPL) and Tesla Inc. (TSLA) with the capability to develop the intellectual capital to design their own chips.

Moreover, almost all of the manufacturing has been outsourced to Taiwan Semiconductor Manufacturing Company Ltd. (TSM), which has yet to diversify significantly outside Taiwan and has become the bone of contention between the two leading superpowers.

In contrast, INTC is an Integrated Device Manufacturer (IDM) which designs as well as manufactures semiconductor chips in 15 fabs worldwide and assembles and tests them in Vietnam, Malaysia, Costa Rica, China, and the United States. The company is in the middle of a turnaround and focused on reinforcing its moat by doubling down on the Fab business.

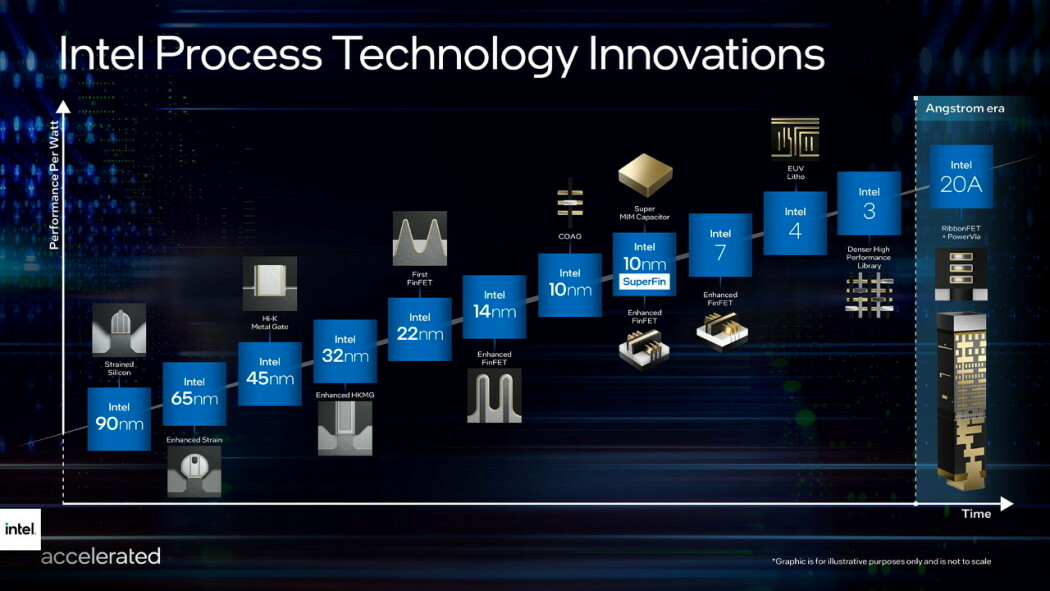

With the aim to surpass the chip-making capabilities of both TSMC and Samsung, INTC is pursuing an aggressive IDM 2.0 road map with new manufacturing facilities in Oregon, New Mexico, Arizona, Ireland, and Israel in the pipeline.

Among those, the new facilities in Arizona would not just be manufacturing chips for the company but also for customers such as Amazon, Qualcomm, and others as part of Intel Foundry Services. While the company still depends on TSMC for 5nm chips that are used for AI applications, it is aiming to take a quantum leap in that direction with even smaller 18 A chips.

The company’s efforts are also receiving much-needed political encouragement in the form of the Chips and Science Act, which is aimed at on-shoring and de-risking semiconductor manufacturing in the interest of national security.

Bottom Line

After weighing the pros and cons of both semiconductor stocks, we conclude that NVDA’s and INTC’s prospective risk-adjusted returns are not as high or as low as their respective stock prices suggest.