Relax, folks. There isn't going to be a long recession, if there is one at all, and you're probably not going to lose your job, and inflation will be down below 3% by next year. The Fed’s got your back.

That's the story from the Federal Reserve’s incredibly optimistic projections released after the end of Wednesday's interest rate-setting meeting. I use the word “incredibly” deliberately, because these projections seem anything but credible. But we can hope.

Somewhat lost in the release of the Fed's 75 basis-point hike in the federal funds rate last Wednesday is that U.S. GDP growth will remain fairly positive this year, next year, and into 2024, according to the Fed’s latest projections.

The Fed now forecasts U.S. GDP will grow by 1.7% this year as well as in 2023, rising to 1.9% in 2024. Now those are down from the Fed’s March projections, to be sure, but they still remain above recessionary (i.e., negative) levels.

Likewise, the Fed is projecting that the unemployment rate will end this year at 3.7% and 3.9% next year, before rising to 4.1% in 2024. Again, those are worse than the March projections but not overly so, considering all the scare talk about how the Fed’s newly hawkish rate-rising policy will inevitably cause a recession and a jump in unemployment.

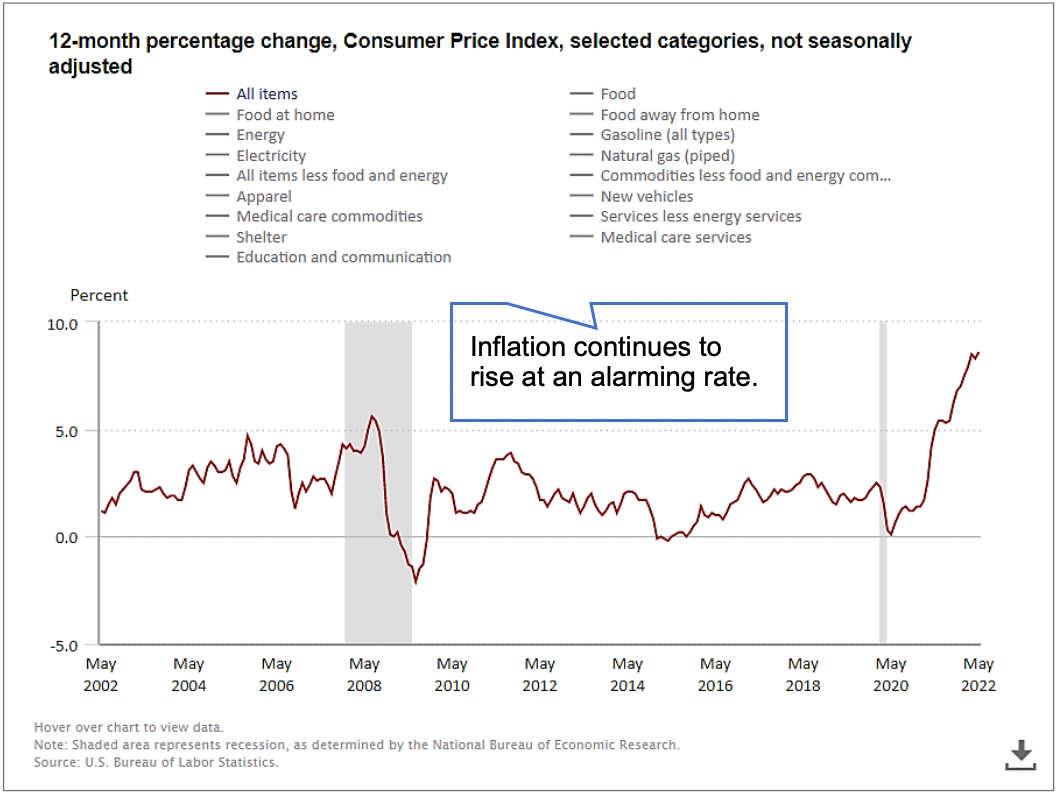

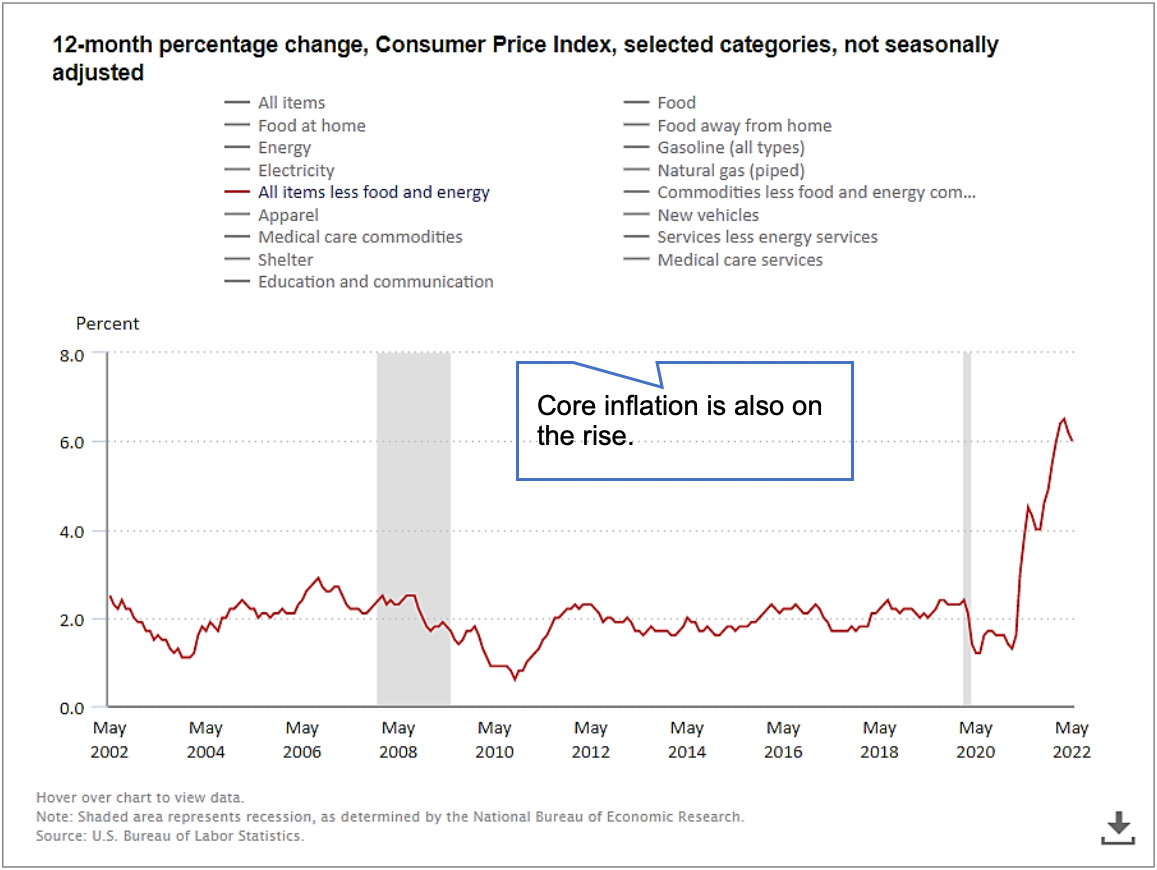

Meanwhile the Fed is also projecting that the PCE inflation rate will end 2022 at 5.2% before dropping in half to 2.6% next year and to 2.3% in 2024, again higher than its March projections but dramatically lower than where we are today at more than 8%.

How does the Fed plan to manage all this, you ask? It sees the fed funds rate reaching 3.4% by the end of this year and 3.8% in 2022, again above its March projections but a lot lower than what you would have expected, given that the yield on the two-year Treasury note is already well above 3%.

In other words, the Fed is merely playing catch-up to where the market has already been for a while.

All in all, I would say, a pretty positive story, a lot better than what we had been expecting. But how much of it can be believed? What the Fed is telling us is that it believes it can really engineer a soft landing, meaning only a moderate rise in the unemployment rate and no recession, at the cost of just slightly higher interest rates, at least compared to today’s inflation rate and current bond market rates.

In other words, the Fed says it can tame inflation back down to less than 3% all while leaving interest rates five percentage points below the current 8% inflation rate. Is that possible?

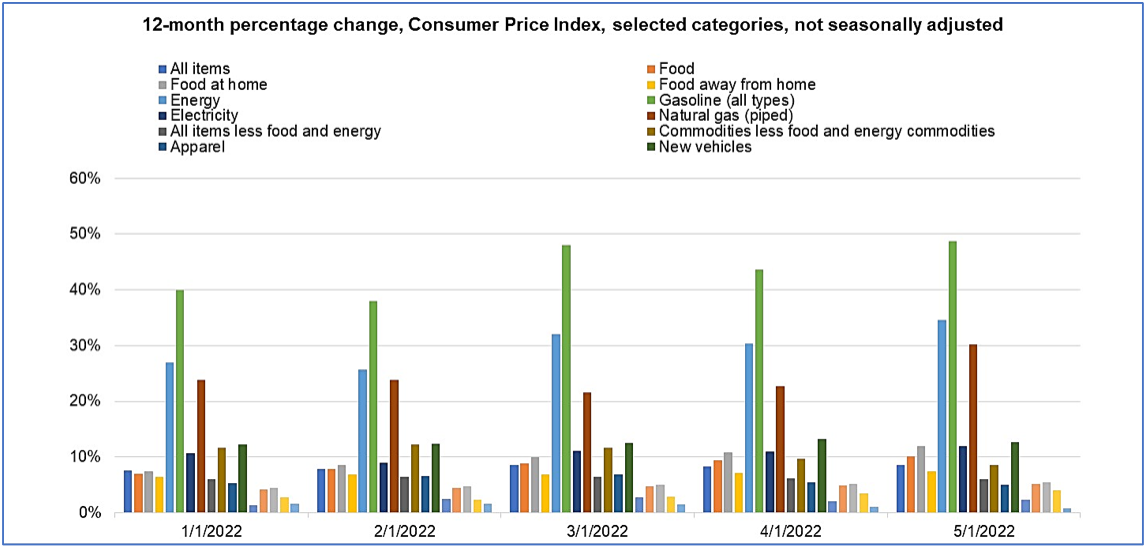

Meanwhile, what is President Biden doing for his part in trying to drive down inflation? Other than not interfering with Fed policy, which he claims is basically all he can do, he is blaming oil executives for the high price of gasoline.

Short of charging them with getting in bed with Vladimir Putin, he's laying the blame for high energy prices on their failure to explore and drill for oil, leaving out his administration's role in basically forbidding them to do just that and putting pressure, through the Fed and other means, not to lend them money in order for them to do so.

You would think Biden would have been happy that they are not drilling for oil, contributing as they are to the blissful carbon-free future he imagines. But he seems to believe he can have it both ways, namely no new oil production and low gas prices. But I guess that’s the same type of logic the Fed is using in trying to convince us it can whip inflation with a few interest rate hikes with little harm to the overall economy.

The market reaction to all this was fairly predictable. Right after the Fed rate announcement was greeted with euphoria on Wednesday, people woke up the next morning and said, “Hey, wait a minute. This can't possibly be true,” and the selling resumed with renewed fervor.

And why not? Can we take any comfort in what the Fed and our government are telling us, which is that after a dozen years of easy money, quantitative easing, artificially low interest rates, and massive fiscal and monetary stimulus, they can undo all that in a year or so without anyone being inconvenienced?

If only it worked that easily. If Powell wanted to be honest, he could have said, “Folks, there will be a lot of pain over the next couple of years to undo all we have done over the past decade, so brace yourselves for it.”

But people don’t want to hear that, especially in an election year. Although the market seems to know better.

Visit back to read my next article!

George Yacik

INO.com Contributor

Disclosure: This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.