It’s all about persisting inflation at the end of the day. All markets watch how the Fed tries to fight it as aftershocks of rate decisions are observed in bonds, stock market, foreign exchange, precious metals and even crypto.

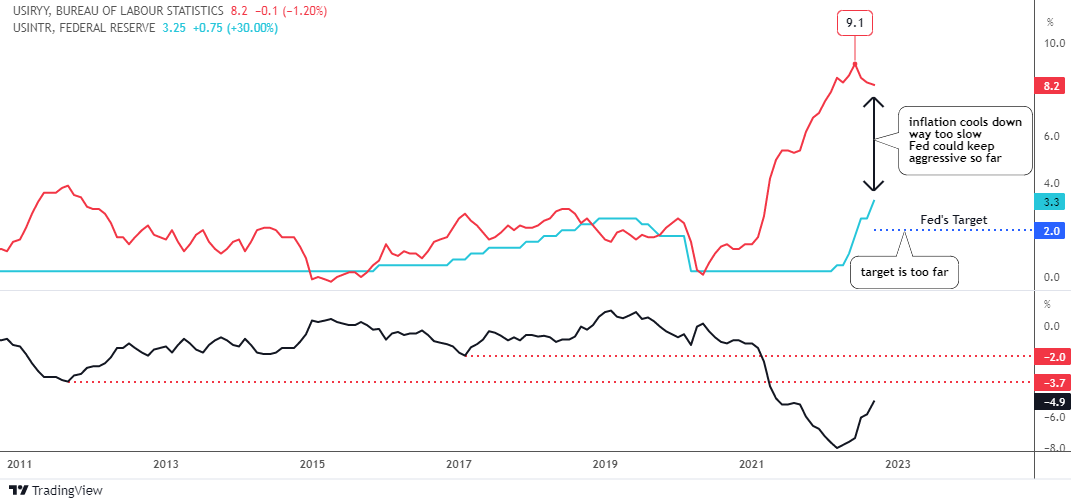

The graph above visualizes that “fight of the night”. Indeed, we witness some progress of the Fed’s efforts in the falling U.S. inflation (red line) numbers from the peak of 9.1% in the summer down to the latest data of September at 8.2%, which was still above the expected 8.1%.

The 3% increase of the Fed rate (blue line) brought inflation down only by 0.9%. It is way too slow, as the inflation target of 2% is still way too far, hence the Fed could keep their aggressive tightening mode.

Surely, there is a time lag between the Fed action and the inflation reaction. However, the time is ticking away as inflation is like a fire - the earlier it's extinguished the better.

The real interest rate (black line, down pane) crossed over the August top above the -5.1%. The next resistance is at -3.7% (valley of 2011) and it is highly likely to be hit soon as it is only 1.2% away. The valley of 2017 in -2% is almost 3% away, which means a huge Fed rate hike or a big drop of inflation. We can’t rule it out anyway.

Indeed, these interest rate projections above could make precious metals life tough. Let's check the gold futures chart below. Continue reading "Gold Update: The Breakdown"