A total of 80 options trades were placed in May, June, July, and thus far in August as the markets rebounded after the COVID-19 lows. During this timeframe, all 80 trades were winning trades to lock in a 100% option win rate with an average income per trade of $189 and an average return on investment (ROI) per trade of 7.5%. After the tumultuous market lows of March and into early April, leveraging a minimal amount of capital, mitigating risk, and maximizing returns was essential. An options-based portfolio can offer the optimal balance between risk and reward while providing a margin of downside protection with high probability win rates. As the market continues to rebound, optimal risk management is essential when engaging in options trading as a means to drive portfolio performance.

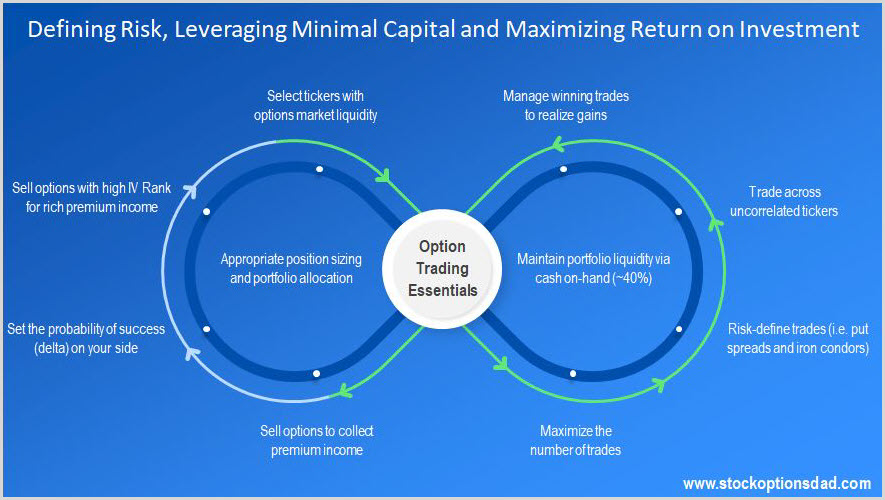

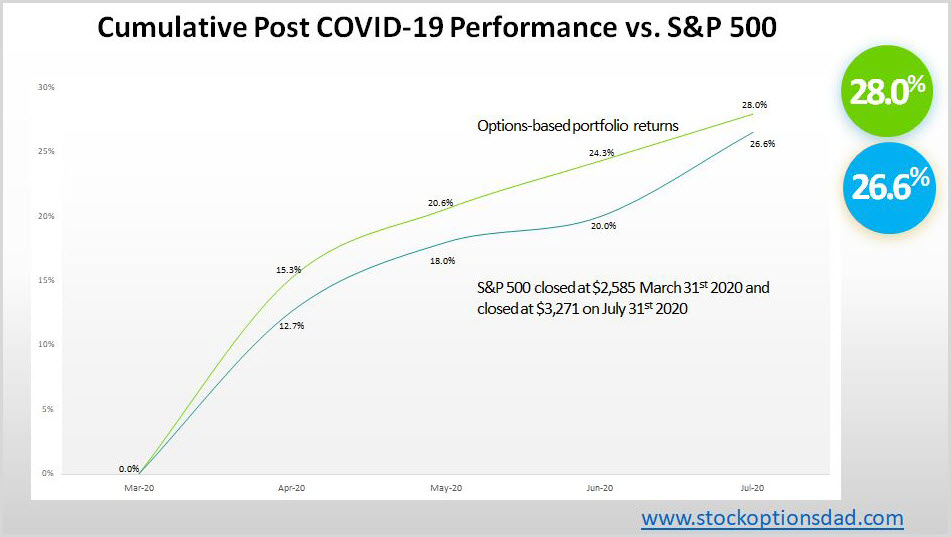

Through the end of July, an option-based portfolio broken out into roughly three equal parts of cash, long equity and options outperformed the S&P 500 by a comfortable margin, posting returns of 28.0% and 26.6%, respectively. When engaging in options trading, risk mitigation needs to be built into each trade via risk-defining trades, staggering options expiration dates, trading across a wide array of uncorrelated tickers, maximizing the number of trades, appropriate position allocation, and selling options to collect premium income. Maintaining disciple via continuing to risk-define trades, leveraging small amounts of capital while maximizing return on investment, is essential despite the impressive streak of 80 consecutive winning trades.

Anchoring Down An Options-Based Portfolio

Anchoring down an options-based portfolio is a key component to taking advantage of black swan events such as COVID-19 via broad-based ETF exposure. During the market lows of March/April, the cash-on-hand component of an options-based portfolio was used to go long equity via Dow Jones (DIA), S&P 500 (SPY), and Nasdaq (QQQ). The cash-on-hand was repurposed to balance out the portfolio into roughly three equal parts of one-third cash, one-third long ETF-based equity, and one-third options driven. Through the end of July, an option-based portfolio broken out into roughly three equal parts of cash, long equity and options outperformed the S&P 500 by a comfortable margin, posting returns of 28.0% and 26.6%, respectively (Figure 1).

Figure 1 – Overall options-based portfolio returns compared to the S&P 500 returns over the previous four months post COVID-19 lows of 28.0% and 26.6%, respectively

4 Months Post COVID-19 Results

After placing 80 trades throughout May, June, July, and thus far in August, a 100% options win rate, 99% premium capture, and 7.5% ROI per trade was achieved. This was accomplished via leveraging a minimal amount of Continue reading "Options Trading - S&P Outperformance Despite Epic Bull Run"