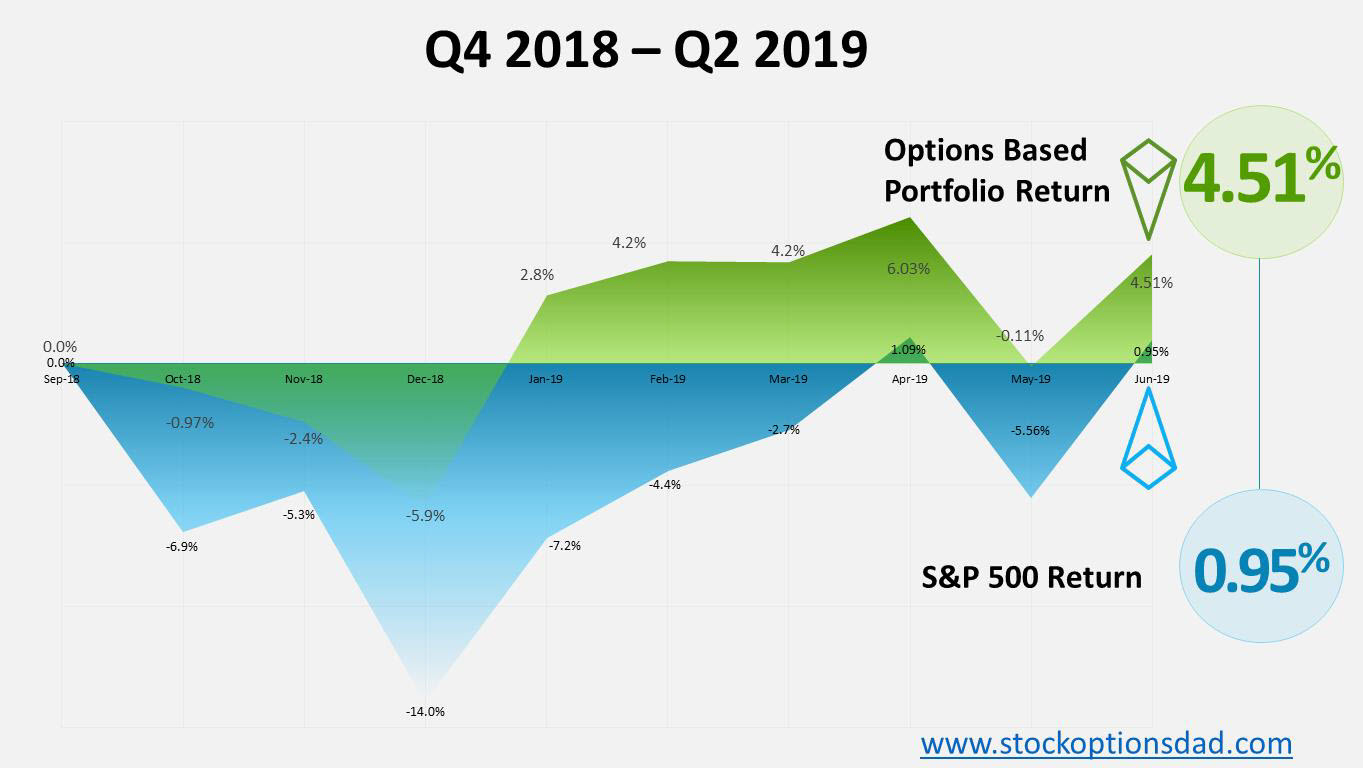

Generating smooth and consistent income month after month without predicting which way the stock market will move is the objective of options trading. Running an option-based portfolio offers a superior risk profile relative to a stock-based portfolio while providing a statistical edge to optimize favorable trade outcomes. Options trading is a long-term game that requires discipline, patience, time, maximizing the number of trade occurrences and continuing to trade through all market conditions. Put simply; an options-based approach provides a margin of safety with a decreased risk profile while providing high-probability win rates. Essentially, options are a bet on where stocks won’t go, not where they will go. Sticking to a set of fundamentals, this approach can provide long-term, high-probability win rates to generate consistent income while circumventing drastic market moves. In July, I posted a 96% (24/25) options win rate, and over the previous 10 months through both bull and bear markets that win rate percentage was 87% (199/230). Over the previous 10 months, the options-based portfolio outperformed the S&P 500 over the same period by a significant margin producing a 6.1% return against a 2.3% for the S&P 500.

What Does Life Insurance Have To Do With Options Trading?

Insurance companies sell policies based on actuaries and risk factors, then price these polices to their advantage. Insurance companies are betting on probabilities across insurance products and sell overpriced policies above their expected losses. The insurer agrees to pay out a specific amount of money for a specific loss (i.e., death). In return, the insurance company is paid monthly premiums, and based on this risk-based revenue model; it’s a very profitable business. Insurance companies sell policies with a premium cost level that maximizes a statistical edge to the insurance company’s benefit. The goal is to collect premiums over the course of the policy and never payout on the policies they sell to you. So, the probability of paying out on the policy is very low while the premiums received, over the policy lifespan will exceed your total benefit. Continue reading "What Does Life Insurance Have To Do With Options Trading?"