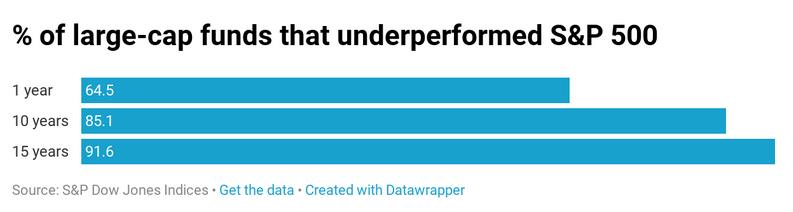

A year-long case study running an options-based portfolio was conducted to demonstrate the effectiveness of this strategy against the traditional stock-picking approach. Options are a great way to manage and mitigate risk while circumventing market swings. Selling options allows you to collect premium income in a high-probability manner while generating consistent income for steady portfolio appreciation regardless of market conditions. Of course, this is all done without predicting which way the market will move since options are a bet on where stocks won’t go, not where they will go.

Primarily sticking with dividend-paying large-cap stocks across a diversity of tickers that are liquid in the options market is a great way to generate superior returns with less volatility over the long term. Over the past 12 months, 298 trades have been made with a win rate of 86% and premium capture of 57% across 69 different tickers. Moreover, when stacked up against the S&P 500, an options strategy generated a return of 6.9% compared to the S&P 500 index, which returned 2.2% over the same period. These returns demonstrate the resilience of this high probability options trading in both bear and bull markets.

This outperformance and high win rate was achieved by following a set of options-based fundamentals. Specifically, position-sizing, sector allocation, maximizing the number of trade occurrences, and risk-defined strategies are some notable areas that traders need to heed for long-term successful options trading.

Essential Options Trading Fundamentals

To effectively and successfully run an options-based portfolio over the long term, the following options trading fundamentals must be exercised in each and every trade. Violating any of these fundamentals will jeopardize this strategy and possibly negate the effectiveness of this approach on the whole. Continue reading "Options Based Portfolio Outperformance - Keys To Success"