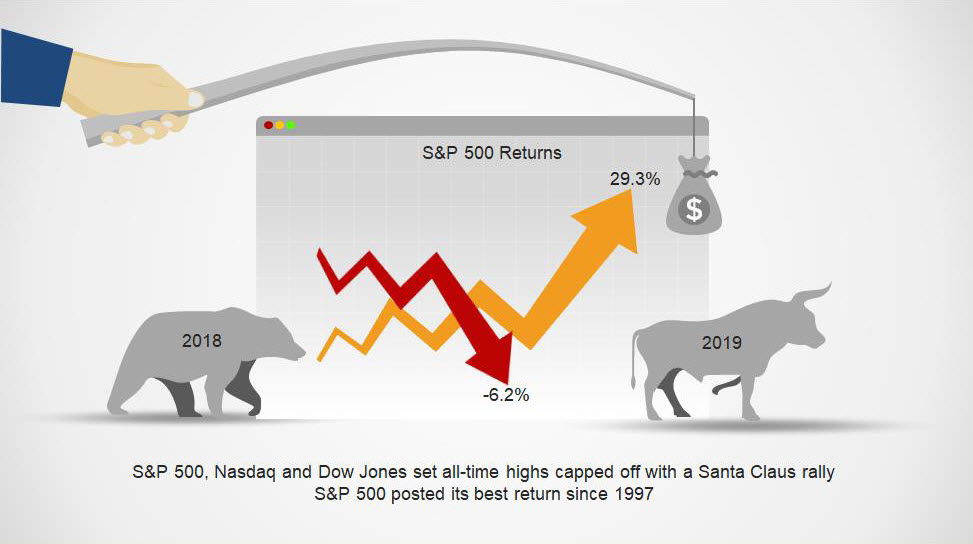

2019 shaped up to be a historic year for the stock market indices. The S&P 500 posted its fourth-best annual return in over 20 years, coming in at a ~29.5% return (my options-based portfolio has generated the same returns). Only two other years have outpaced these 2019 returns. These occurred in 1995 and 1997, posting returns of 34.1% and 31.0%, respectively. 2019 was a unique year on multiple fronts, most notably because the market returns outpaced even the most bullish forecast by any Wall Street analyst. The markets roared higher in the face of impeachment proceedings, U.S.-China trade war, Federal Reserve actions, inverted yield curve, and slowing economies abroad. Furthermore, for the first time in history, the U.S. economy has started and ended a decade without a recession, with the economy expanding for a record 126 consecutive months (Figure 1).

Figure 1 – S&P 500, Nasdaq, and Dow Jones all set all-time highs as 2019 came to a close. The markets are in rarified territory with stretched valuations absent of any volatility. The Santa Claus rally capped off a euphoric market, generating the best returns in over 20 years

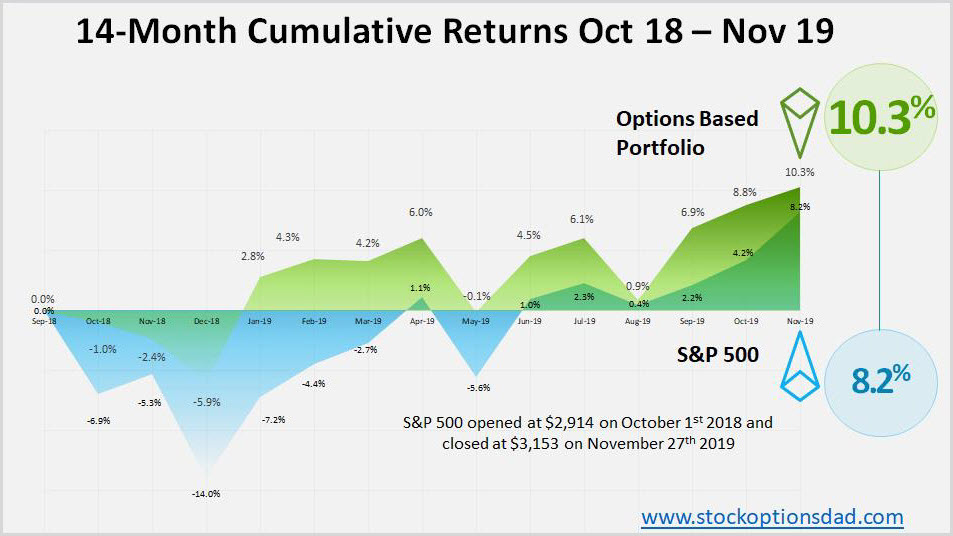

A data-driven, options-based portfolio sells options and collects premium income in a high-probability manner to generate consistent income for steady portfolio appreciation. This strategy mitigates risk and circumvents drastic market moves and is done without predicting which way the markets will move. Options are a great way to generate superior returns with less volatility in both bear and bull market conditions over the long term. Despite my 2019 performance lagging the S&P 500, the options-based strategy has generated the same returns when factoring in the Q4 2018 market sell-off. As 2019 comes to a close, my options-based portfolio returned ~19% relative to the S&P 500 return of 29.5%. Despite the epic 2019 market, when including the market sell-off of Q4 2018, my options-based portfolio has returned 11.6% relative to the S&P 500 return of 11.2%. I was able to achieve the same market performance over the past 15 months with my current cash position at ~50% of my portfolio. Continue reading "Options-Based Portfolio: 50% Cash and Matching S&P 500 Returns"