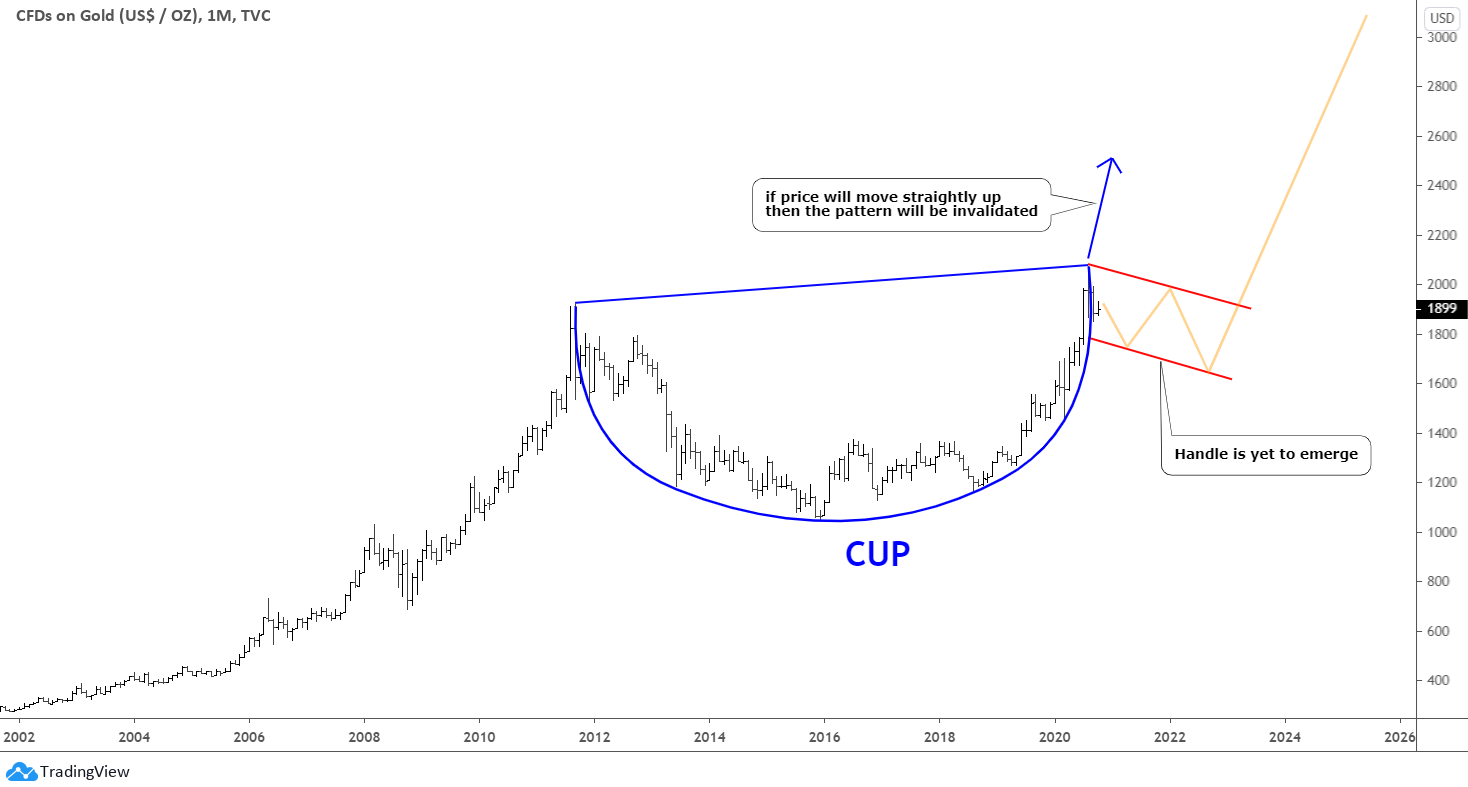

We entered the most awaited period of the year when gold bugs could enjoy the traditional end of the year Santa Claus Rally. Let's check the charts to see if everything is setting up for a rally.

Most of you were right that the U.S. dollar index (DXY) will not follow the pink clone to the upside and continue down.

The DXY finally broke the valley of a consolidation. This gave the acceleration to the move down and buoyed the precious metals' prices significantly. Now, there are no other barriers ahead of the former valley area of 88. The DXY, aka "King," could dress up like a Santa, at least for gold. Please read till the end to see why I didn't mention silver. Continue reading "Could Santa Only Visit Gold?"