By: Gary Tanashian of Biiwii.com

Last night’s post on the US stock market ended as follows:

“As far as the Fed and its puny rate hikes are concerned, that is irrelevant. This market is flipping them the bird. Markets can rise a long way before a rate hike regime finally kills them. It feels like inflation folks.”

This prompted a question from an NFTRH subscriber about what markets would benefit, and in what differing ways would they benefit if an inflationary phase comes to dominate? That is a far reaching question and a difficult one as well, because inflation’s effects have a way of being unpredictable (how many would have answered ‘US stock market’ in the spring of 2011 to the question “where will the post-crisis inflation to date manifest on this cycle”?).

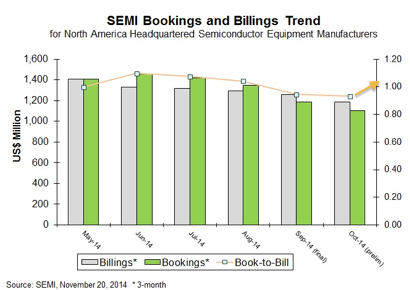

Last weekend, in an NFTRH 396 excerpt we talked about Applied Materials stellar quarterly report and what it might mean for the economy, the Fed, the gold sector and most of all the idea of an inflationary backdrop becoming more readily apparent (2003-2007 Greenspan style). Continue reading "It Feels Like Inflation"