On Tuesday, March 8, gold futures traded to an intraday high of $2078, roughly $10 below the all-time high of $2088, which was achieved in August 2020. The current decline in gold is the first real price decline since January, when gold hit a low of approximately $1780. Until Tuesday of this week, what followed in February was a dynamic rally resulting in gold gaining approximately $300 when gold traded to $2078. On Wednesday, March 9, gold opened above Tuesday’s closing price of $2043 but closed dramatically lower, resulting in a price decline of $72. Tuesday’s strong decline resulted in gold losing 3.49% in value, the largest single-day loss in 2022.

As of 4:45 PM EST on Friday, March 11 gold futures basis, the most active April Comex contract is currently fixed at $1990.20, a net decline of $10.30 or 0.51%. However, this decline can be largely attributed to dollar strength. Currently, the dollar is up by 0.63% and with the dollar index fixed at 99.12. While gold pricing is lower today, it is completely the result of dollar strength and fractional buying of gold.

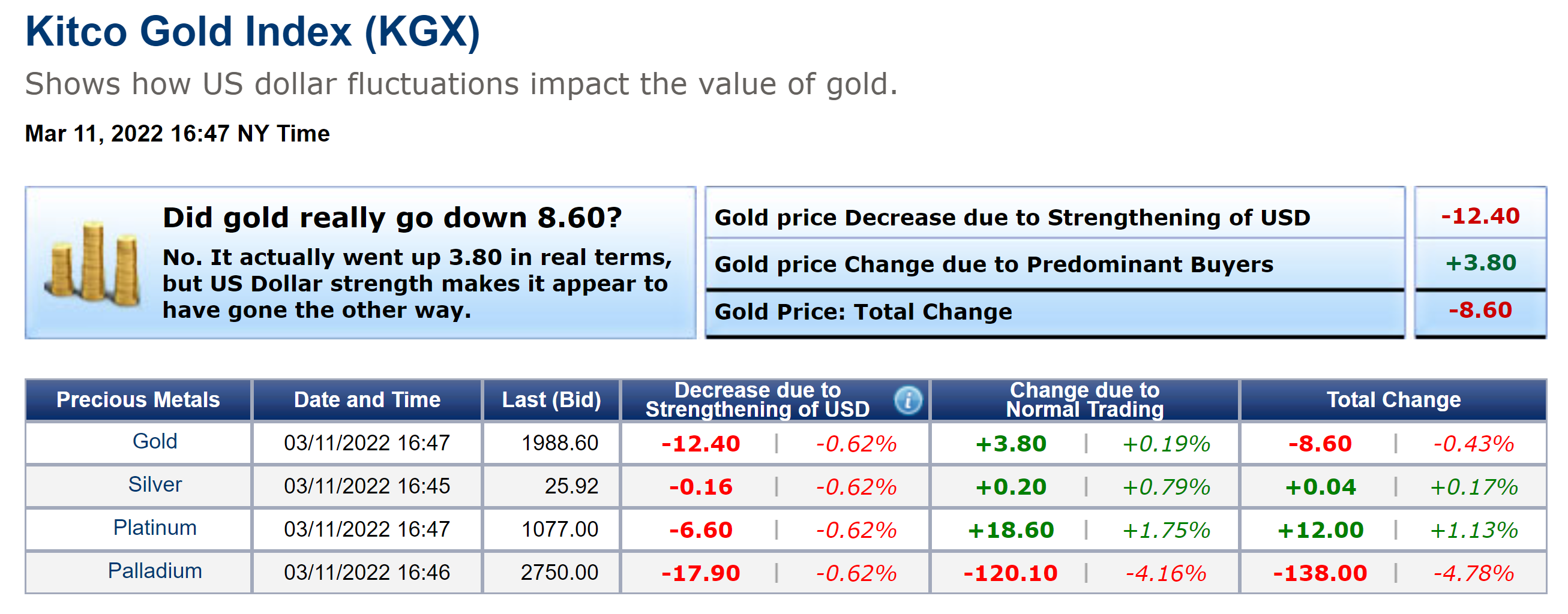

Currently, spot gold is fixed at $1988.60, a net decline of $8.60 on the day. The Kitco Gold Index shows that dollar strength resulted in gold declining $12.40, and fractional buying resulted in a gain of $3.80, resulting in the net change today of -$8.60. Continue reading "Gold Corrects After Challenging Record High"

Today's guest is Gary Wagner featured

Today's guest is Gary Wagner featured