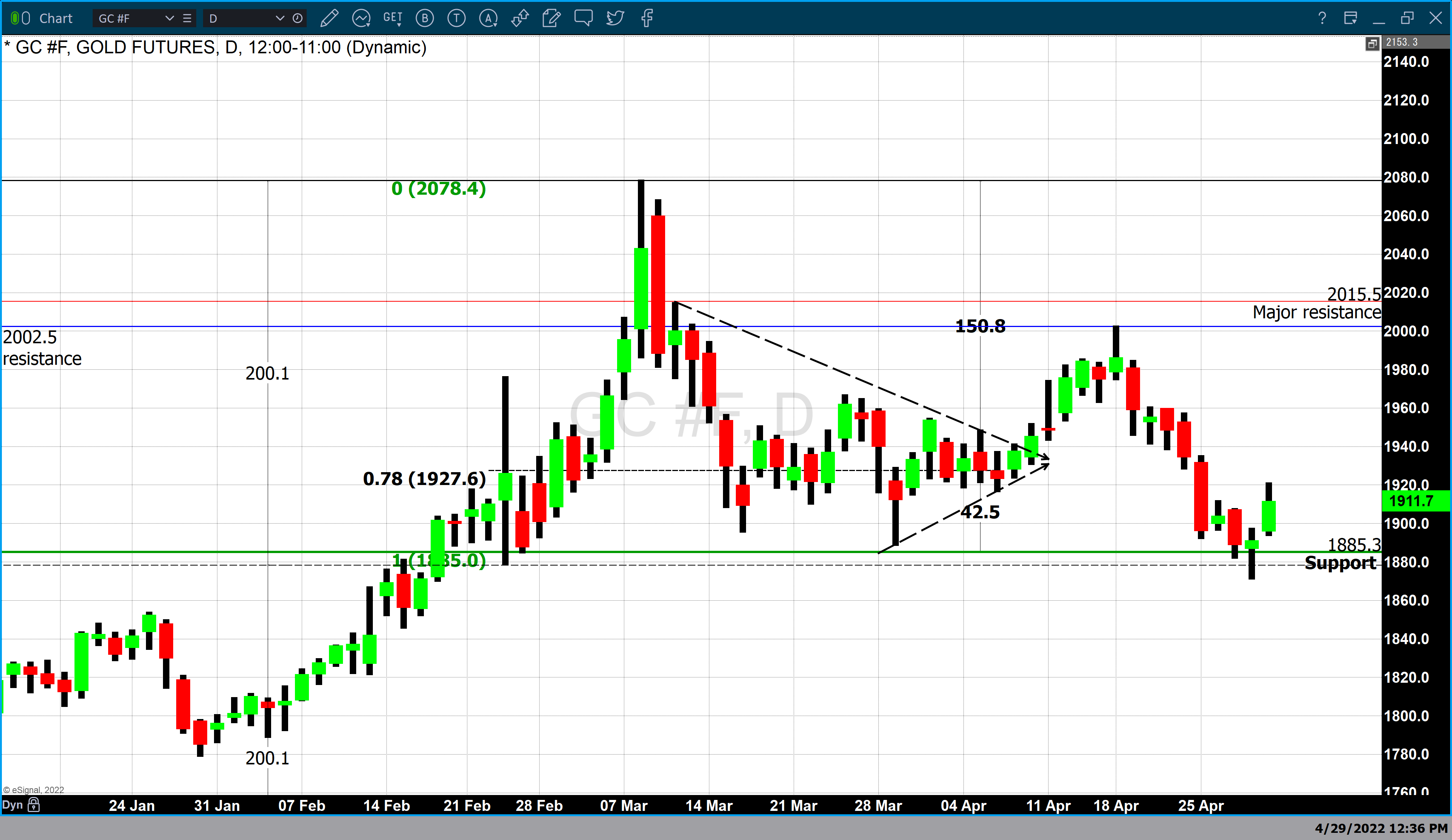

Gold prices closed higher on the day and the week resulting in solid gains. As of 5:50 PM, ET gold futures basis most active June contract is currently up $3.90 or 0.21%, fixed at $1845.10. Considering that gold futures traded to a low this week of $1785 and closed near the highest value this week of $1848.60, it had a good week.

Gold pricing had been under pressure for the fourth consecutive week before this week's trading activity resulting in defined technical chart damage with it breaking below its 200-day moving average last Thursday, May 12. This week's low occurred on Monday, May 16, when prices hit a low of $1785 and traded to a high of $1825 before closing above its opening price on Monday and above Friday's closing price at $1813.60. On Tuesday, gold traded to a higher high and a higher low than Monday, even though gold closed fractionally lower than its opening price. On Wednesday, gold traded to a lower low and a lower high than Tuesday's price action, but that all changed on Thursday. Continue reading "Gold Posts Solid Gains For The Week"