S&P 500 Futures

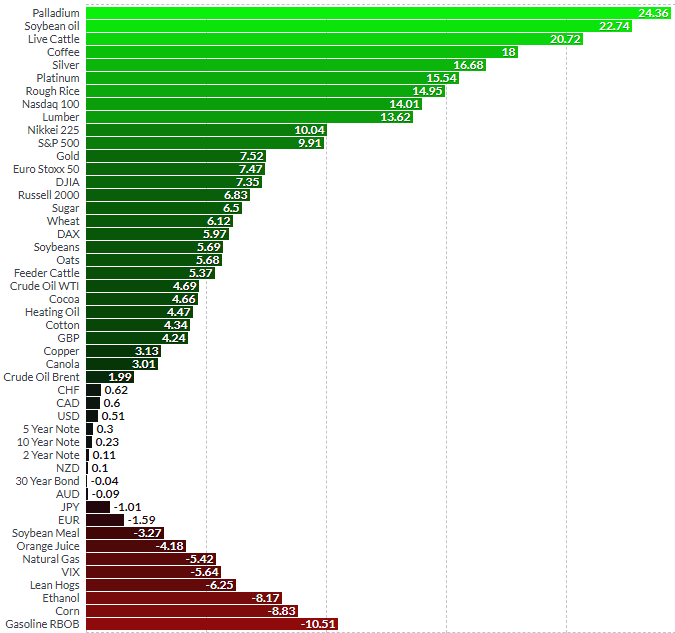

The S&P 500 in the March futures contract is currently trading at 3332 after settling last Friday in Chicago at 3325 continuing its bullish momentum to the upside despite fears of the Coronavirus spreading affecting global growth.

The S&P 500 is trading higher for the 3rd consecutive session, hitting another all-time high this week, and if you are long a futures contract place the stop loss under the 2 week low which now stands at 3260. The chart structure will improve next week, therefore, lowering risk as this gravy train continues to the upside as earnings have been very solid.

I see absolutely no reason to try to pick a top and get short this market. If you have been following any of my previous blogs, you understand that I think 2020 will be a good year for the stock market as January is off to an excellent start, up about 4%.

The S&P 500 is trading far above its 20 and 100-day moving average as this is one of the strongest trends to the upside. That is why trading with the path of least resistance is the most successful way to trade over time as picking tops or bottoms is extremely difficult and fruitless, in my opinion.

TREND: HIGHER

CHART STRUCTURE: SOLID

VOLATILITY: AVERAGE

Platinum Futures

Platinum futures in the April contract are ending the week on a positive note up $10 at 1,017 after settling last Friday at 1,024 in New York down slightly for the trading week still consolidating the recent run-up that we have experienced over the previous couple of months. Continue reading "Bullish Momentum Continues For Futures"