The king currency has finally hit the first long-term target of $114 that was set in the summer of a distant 2019 when it traded around $96.

That aim wasn’t clear then as the dollar index (DX) looked weak in the chart. The short-term structure was similar to a pullback after a heavy drop.

The majority of readers did not believe the DX would ever raise its head as you can see in the 2019 ballot results below.

However, I had found a bullish hint in a very big map, and I warned you “Don't Get Trapped By Recent Dollar Weakness”.

Back in August, you had already been more bullish on the dollar as you voted the most for the target of $121.3 in the earlier post. This confidence is due to the certain position of the Fed, which resolutely fights the inflation, lifting the rate aggressively round by round.

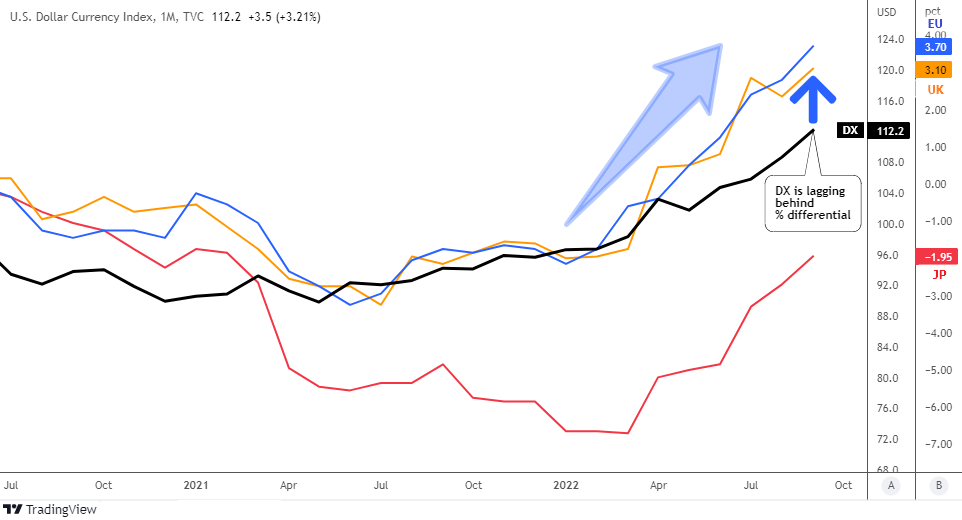

Let me update the visualization of the real interest rate comparison below to see if the dollar still has fuel to keep unstoppable.

The real interest rate differentials are shown on the scale B: blue line for U.S. - Eurozone, orange line for U.S. – U.K. and the red line for U.S. – Japan. Continue reading "The Dollar Has Hit The First Target"

Hello traders everywhere! Adam Hewison here, President of INO.com and co-creator of MarketClub, with your

Hello traders everywhere! Adam Hewison here, President of INO.com and co-creator of MarketClub, with your