Curbing Inflation - The Priority

Rolling back inflation is an absolute necessity before these markets can start to turn back this tide of relentless selling. The process of curbing inflation will not be quick, nor will it be an easy feat. A delicate balance must be exercised to curb inflation via rising rates while not destroying the economy.

To curtail these 40-year highs in inflation, the economy will need to slow, demand will need to cool and the supply chain will need time to catch up to come back into balance.

The Federal Reserve will raise short-term interest rates from historic lows near zero as the economy recovered from the pandemic. The Federal Reserve will be looking for lower CPI numbers, softer labor market conditions and resolution of supply chain constraints prior to taking a dovish stance on future rate hikes. The latter will be the confluence of catalysts the market needs to propel higher.

Overall Markets

The overall markets have been under heavy and relentless selling. The average Nasdaq stock has undergone a 50% drop from its high.

The S&P 500 now trades at a level first reached more than 16 months ago in early February 2021. This move negates the post-Covid advance in equities.

The multi-wave corrections that culminated in February 2016 and December 2018 both bottomed at levels first reached nearly two years prior. Thus, these markets are reaching the point where the past two years of appreciation has been erased.

Bank of America’s Bull & Bear Indicator, which captures fund flows and other market-based risk-appetite measures, is well in the fearful depths that typically imply a buying opportunity. During prolonged stressed periods (i.e., 2000-’02 and 2008-’09) bear markets had this gauge persistently stuck at these low levels while prices continued to trend lower.

University of Michigan consumer sentiment poll came in at a level lower than during the global financial crisis and if not revised higher will rank as the bleakest monthly reading since 1978. Extreme negative readings in the University of Michigan poll have served as great inflection points for how stocks perform over the subsequent 12-month period.

Per JPMorgan the S&P 500 has averaged a 25% gain in the year following the eight Michigan sentiment troughs going back 50 years, with the worst return at 14%.

It’s noteworthy to point out that hindsight is 20/20 thus troughs are only known in a look-back analysis after sentiment starts to recover from a low. The markets may be close but may not be at this point yet.

Key Macroeconomic Factors

The Consumer Price Index (CPI) has become the most influential and critical variable in today’s market. The CPI readings directly impact monetary policy put forth by Federal Reserve via interest rate hikes, bond buying and liquidity measures.

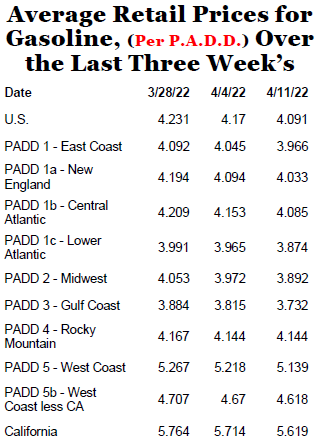

Inflation continues to be persistent throughout the economy and the Federal Reserve must balance curtailing inflation without destroying the economy. The impact of inflation is now flowing through to companies and consumers alike. Inflation has reared its ugly head and is now negatively impacting companies’ gross margins and dampening consumer demand due to soaring prices, specifically gasoline.

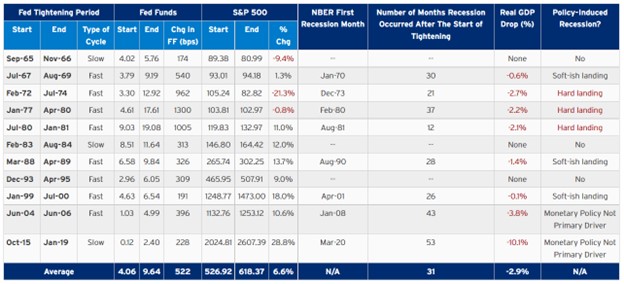

The confluence of rising interest rates, inflation, China Covid lockdowns and the war in Ukraine has resulted in first half of 2022 overwhelmingly negative. As such, the market appears to be factoring in a worst-case scenario that may result in a Federal Reserve induced recession as a function of over-tightening on monetary policy and/or its inability to combat inflation responsibly to engineer an economic “soft landing”.

However, if any of these macroeconomic factors abate (i.e., CPI, China re-opening, Russian/Ukraine conflict and interest rate hikes) this could serve as a launching pad for the markets to stabilize and appreciate higher.

Inflation - 40 Year Highs

Inflation pushed higher in May as prices rose 8.6% from a year ago for the fastest increase in nearly 40 years. Excluding volatile food and energy prices, core CPI was up 6%. Both CPI and core CPI exceeded estimates and came in hotter than expected. Surging costs for shelter, gasoline and food prices all contributed to the increase.

The latest CPI numbers casted doubt that inflation may have peaked and adds to fears that the U.S. economy is nearing a recession.

The CPI report comes at a time when the Federal Reserve is in the early stages of a rate-hiking campaign to slow growth and bring down prices. May’s report likely locks-in multiple 50 basis point interest rate increases ahead. With 75 basis points of rate rises already put in place, markets widely expect the Fed to continue tightening through 2022 and likely into 2023.

Conclusion

Curbing inflation is an absolute necessity for the markets to stabilize and start to reverse the tide of relentless selling. A delicate balance must be exercised to curtail these 40-year highs in inflation.

As a consequence, the economy will need to slow, demand will need to cool and the supply chain will need time to catch up to come back into balance.

The Federal Reserve will be looking for lower CPI numbers, softer labor market conditions and resolution of supply chain constraints prior to taking a dovish stance on future rate hikes. The latter will be the confluence of catalysts the market needs to propel higher.

The Consumer Price Index (CPI) has become the most influential and critical variable in today’s market. The impact of inflation is now flowing through to companies and consumers alike with Target and Walmart issuing profit warnings.

The market appears to be factoring in a worst-case scenario that may result in a Federal Reserve induced recession as a function of over-tightening on monetary policy and/or its inability to combat inflation responsibly to engineer an economic “soft landing”. It will likely take successive downward CPI readings before rates will stabilize and the markets can appreciate higher.

However, if any of the other macroeconomic factors abate (i.e., China re-opening and Russian/Ukraine conflict) this could serve to accelerate the stabilization of the markets and remove the functional constraints for the markets to appreciate higher.

Noah Kiedrowski

INO.com Contributor

Disclosure: Stock Options Dad LLC is a Registered Investment Adviser (RIA) firm specializing in options-based services and education. There are no business relationships with any companies mentioned in this article. This article reflects the opinions of the RIA. Any recommendation contained in this article is subject to change at any time. No recommendation is intended to constitute an entire portfolio. The author encourages all investors to conduct their own research and due diligence prior to investing or taking any actions in options trading. Please feel free to comment and provide feedback; the author values all responses. The author is the founder and Managing Member of Stock Options Dad LLC – A Registered Investment Adviser (RIA) firm www.stockoptionsdad.com defining risk, leveraging a minimal amount of capital and maximizing return on investment. For more engaging, short-duration options-based content, visit Stock Options Dad LLC’s YouTube channel. Please direct all inquires to

in**@st*************.com

. The author holds shares of AAPL, ACN, ADBE, AMD, AMZN, ARKK, AXP, BA, BBY, C, CMG, CRM, DIA, DIS, FB, FDX, FXI, GOOGL, GS, HD, HON, IBB, INTC, IWM, JPM, MA, MS, MSFT, NKE, NVDA, PYPL, QCOM, QQQ, SBUX, SPY, SQ, TMO, and V.