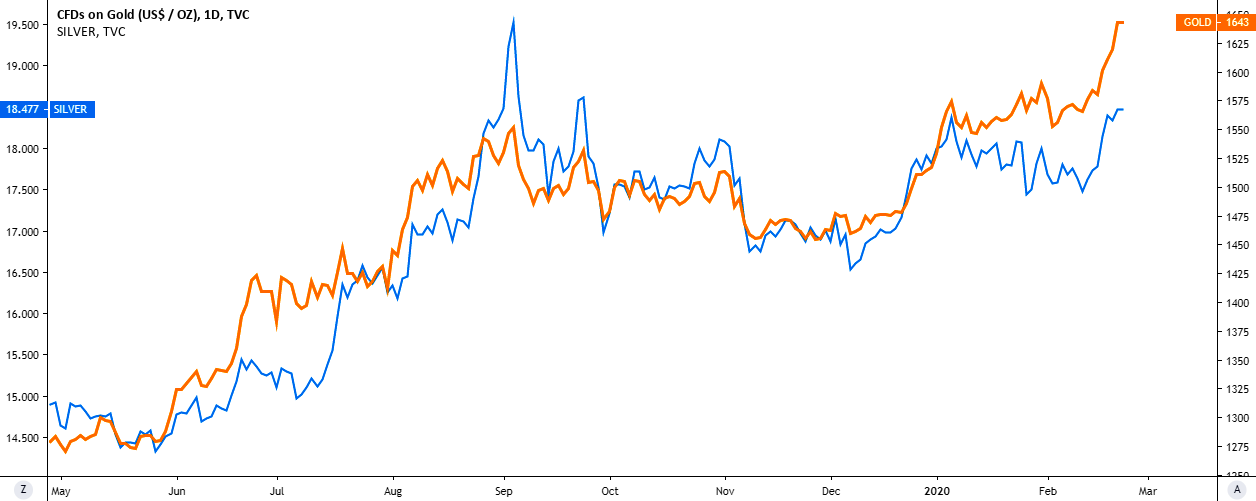

Before we start analyzing gold, let’s see how two precious metals behave in comparison on the chart below.

Chart courtesy of tradingview.com Gold (orange, right scale), Silver (blue, left scale)

This chart above starts from the bottom area of 2019. The most of the time, the yellow metal leads the game as Silver follows suit showing sharp moves to catch up with the gold. Sometimes the laggard throws over the leading trend amid excessive market reaction to the big moves of the top metal. Such extremes are rare and quickly get normalized by market “whales.” From this perspective, there is nothing new we can find on the chart. Continue reading "Gold Hits Target And Seven Year High"