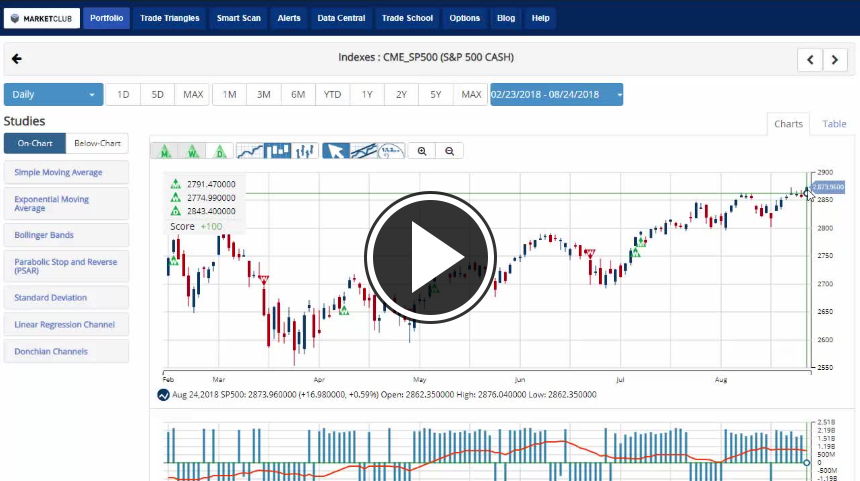

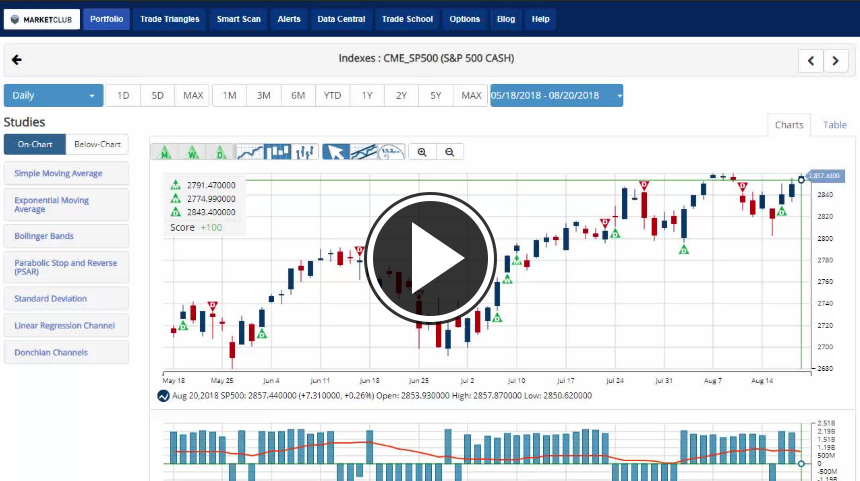

Hello traders everywhere. Speaking at the central banks annual Jackson Hole retreat, Federal Reserve Chair Jerome Powell said the central bank's current approach to interest rate hikes were the best way to protect the U.S. economic recovery. In turn, that statement sent the S&P 500 and NASDAQ to record highs in early trading with the NASDAQ hitting $7,949.25 and the S&P 500 hitting $2,876.16. Are the $8,000 and $3,000 levels on tap for next week?

Powell's speech caused the U.S. dollar to retreat further after having a rough week to begin with and now losing over -1% for the week. That move lower gave room for the precious metals, namely gold and silver, and crude oil to head higher. That triggered a new green weekly Trade Triangle for oil indicating that the commodity could be heading higher. But it still has some work o do to break out of the channel that it's been trapped in.

Key Levels To Watch Next Week:

Continue reading "Powell Stays The Course Propelling Stocks Higher"