The bull run that started in December had to take a breather after it extended into 2021 and this week was the week. Six of the seven markets that we track weekly will finish the week down, and the one market that is up may shock you.

We'll start with the three major indexes. The S&P 500, DOW, and NASDAQ will post their first weekly loss of the year and the first in four weeks, with losses standing at -1%, -.6%, and -1%, respectively.

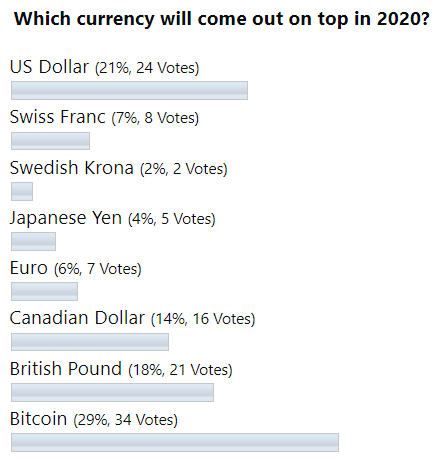

The week's surprising winner is the US Dollar with a weekly gain of +.6%, marking its second straight week of gains, which was enough to trigger a new green weekly Trade Triangle, moving the US Dollar to a sidelines position. Continue reading "First Losing Week Of 2021"