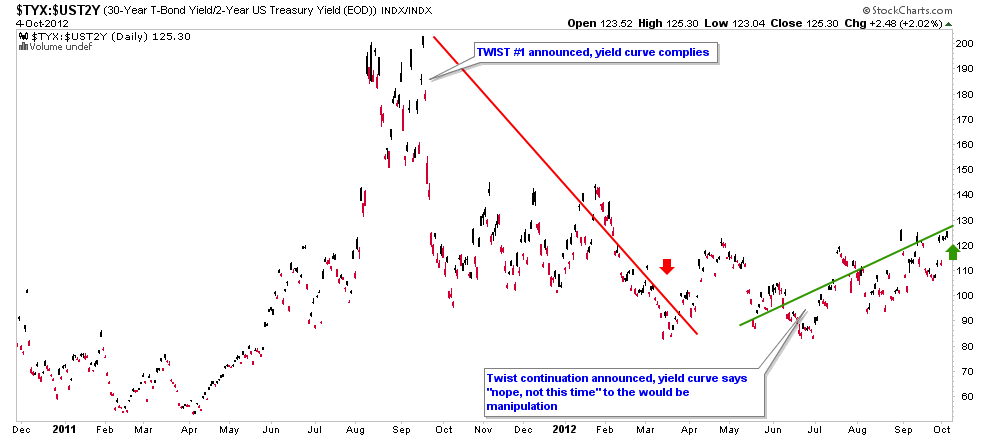

Using the spread between 30 year and 2 year US Treasury yields, we can gauge when policy makers are in control of market participants’ perceptions and when they are losing control to the free market’s will.

Operation Twist was announced in September of 2011 in the aftermath of the first phase of the Euro crisis as the yield curve had exploded higher, taking the monetary stress barometer, gold, with it. Over bought on unbridled momentum, gold entered an extended correction in line with the yield curve, which complied with policy makers’ goal of calming down the system. As shown many times in the past, gold and the 30-2 yield curve generally travel together. Continue reading "Systemic Stress is Building, and it’s Bullish (for now)"

Excerpted from the September 30 edition of Notes From the Rabbit Hole:

Excerpted from the September 30 edition of Notes From the Rabbit Hole: