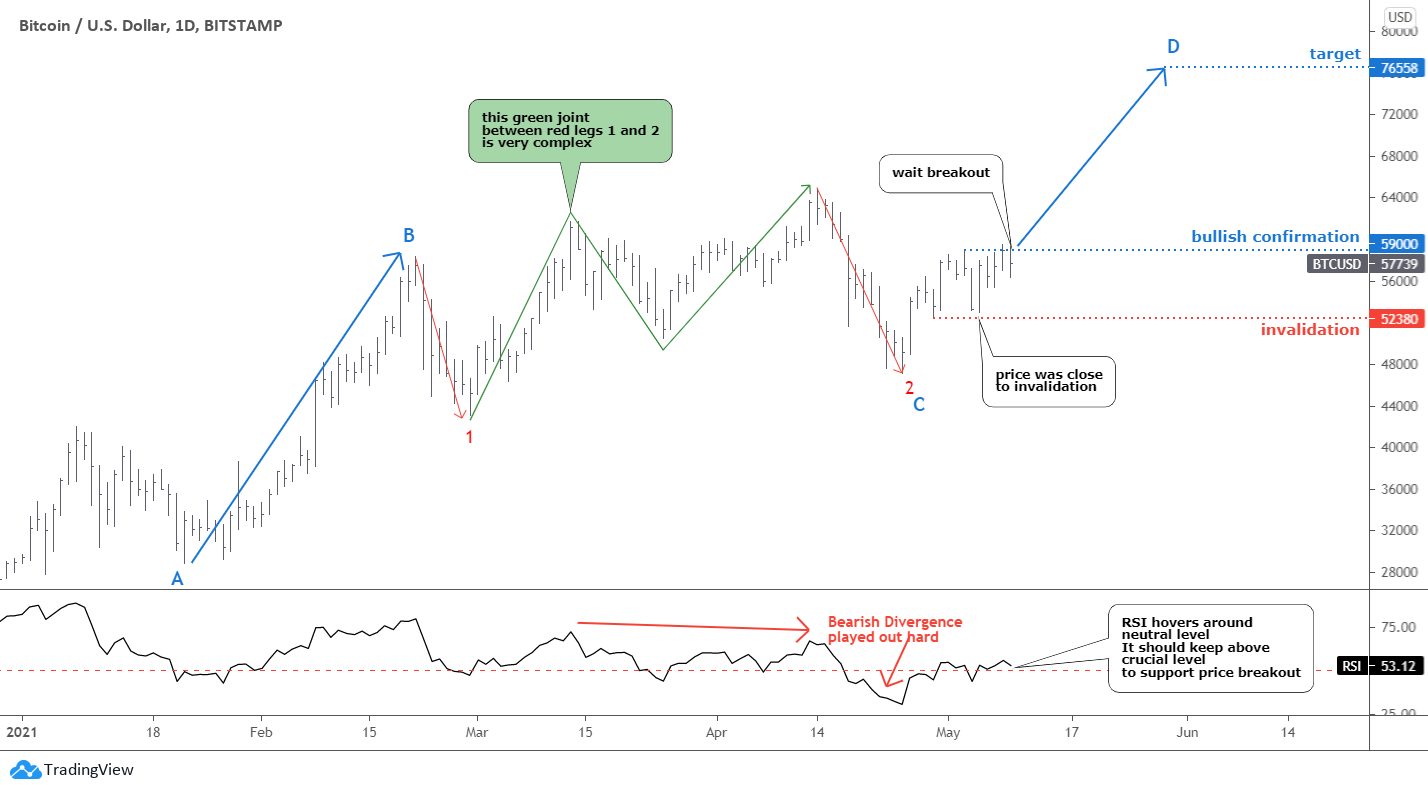

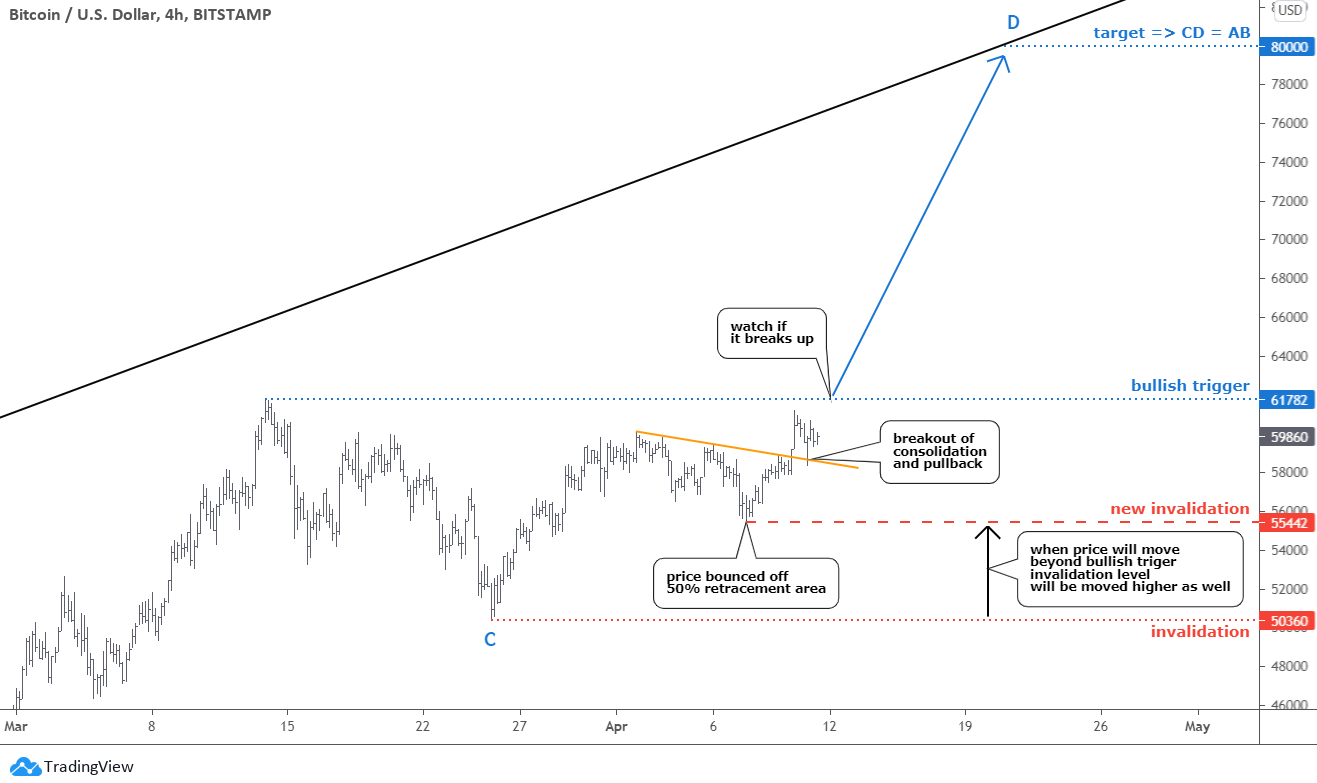

The bullish setup for Bitcoin that I discussed last week was not triggered, as the price did not break above the bullish confirmation level. The price went the opposite direction, falling beneath the invalidation trigger instead.

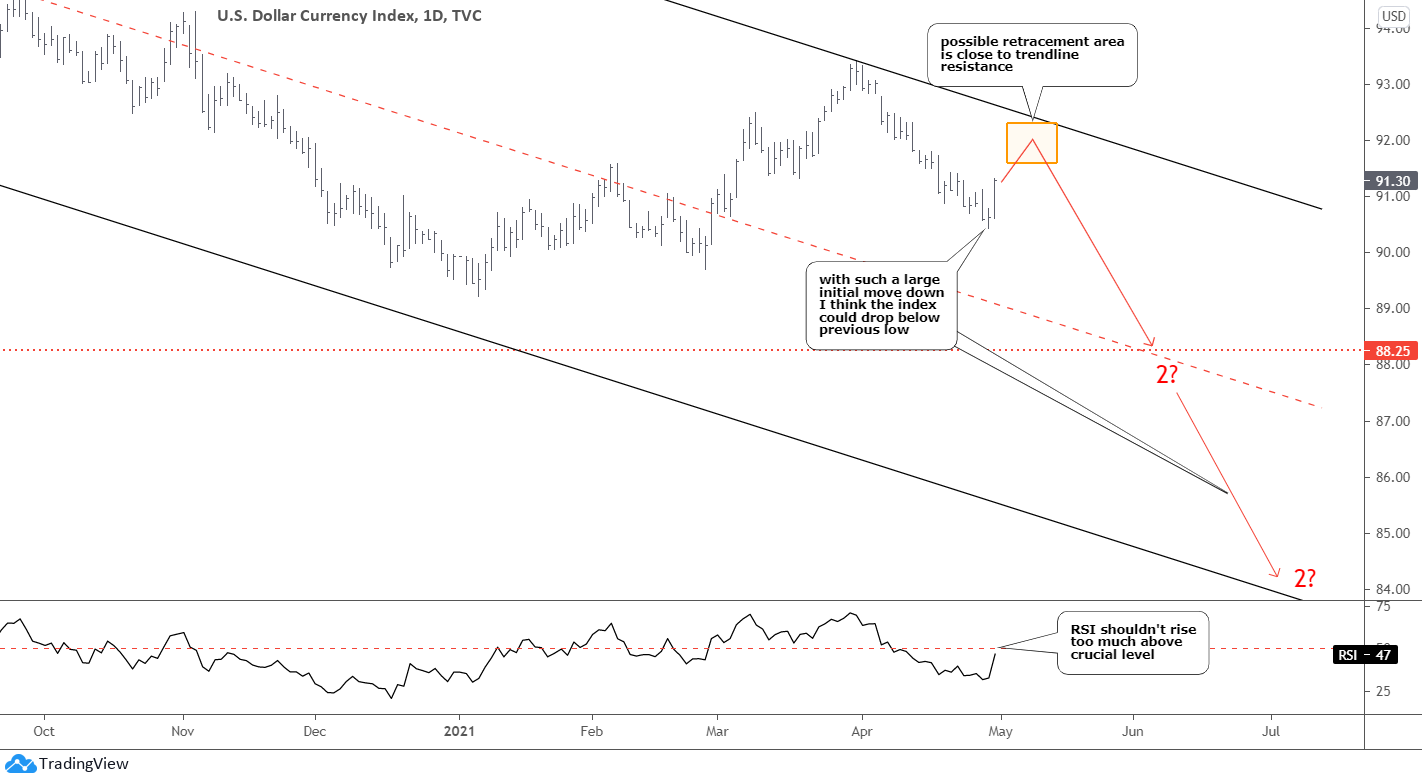

The key factors for the sell-off were the U.S. probe into the Binance crypto-exchange, and Tesla is reversing its stance on accepting Bitcoin. The green economy does not support Bitcoin due to its vast electricity consumption, which is generated primarily from fossil fuels.

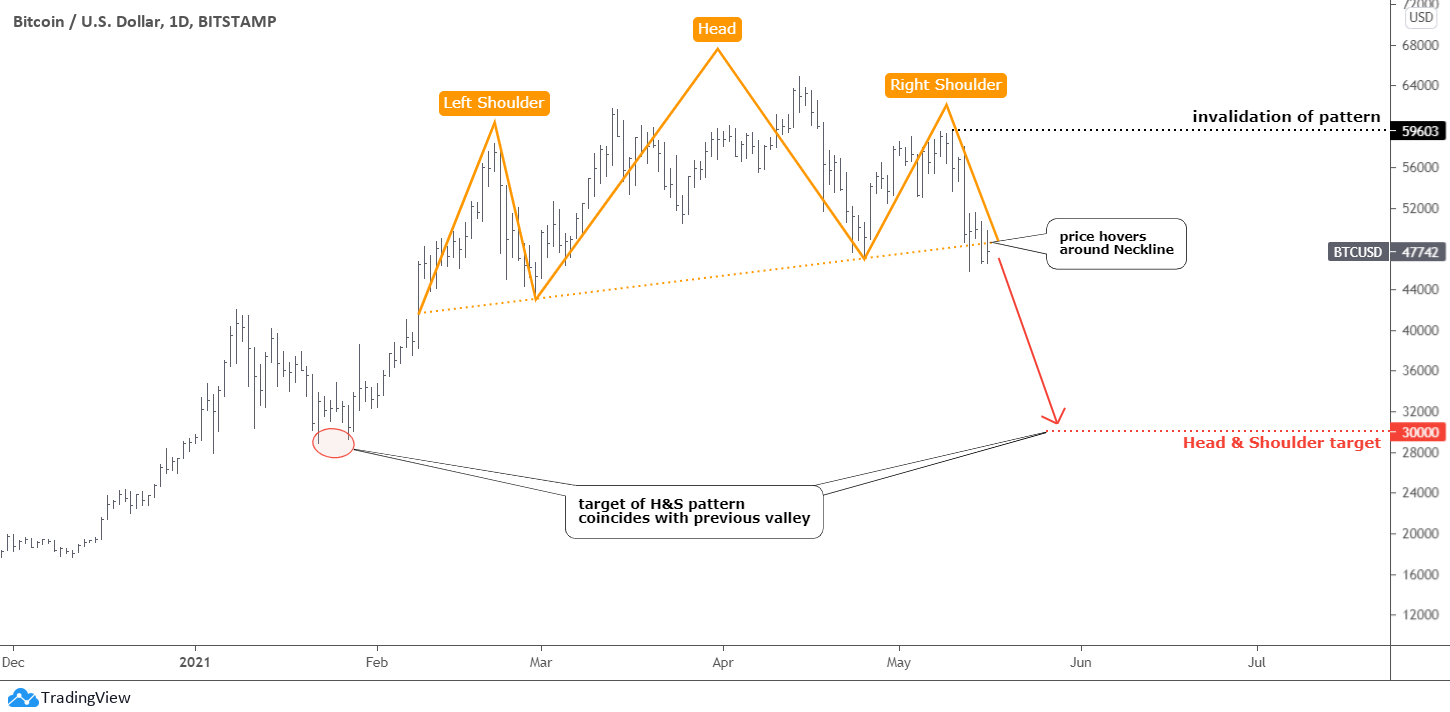

The combination of peaks in one area with the highest one in between has built the famous Head & Shoulders reversal pattern (orange). The main focus now is on the orange dotted Neckline as the price hovers around that support. A clear breakdown of it is needed for the pattern to play out. Continue reading "Bitcoin, Ethereum, And Ripple"