Anheuser-Busch InBev SA/NV (BUD), a leading multinational brewing company once hailed as one of the largest firms within its sector, is widely recognized for housing popular brands such as Stella Artois, Beck's, and Budweiser in its extensive portfolio.

The corporation has a notable history of collaborating with celebrities and social media influencers to enhance its beer promotions. However, its recent partnership with the prominent transgender influencer Dylan Mulvaney sparked both condemnation and commendation from various factions, thus generating significant media attention.

This alliance became embroiled in a heated controversy tied to a Bud Light campaign focused on the transgender community. Consequently, amid the media fuss, the brewing giant's stock declined about 20% in May. Fanning the flames of their troubles, BUD’s layoff of more than 300 U.S. employees accentuated the growing challenges faced by the company.

The Controversy and Its Impact

BUD partnered with Mulvaney to amplify its “Easy Carry Contest,” offering customers a chance to win a grand prize of $15,000 for sharing videos of themselves carrying as many cans of BUD's beer as possible. To promote the contest, Mulvaney posted a sponsored video on TikTok in April 2023, featuring a Bud Light can adorned with her face, gifted by the company upon the first anniversary of her public declaration as transgender.

However, this instigated severe criticism from conservative anti-trans groups, who perceived this move as Bud Light pushing a certain "agenda." Consequently, calls for a boycott against the beer brand erupted.

Bud Light’s share of the U.S. beer revenue had plummeted to 8.9% by the week ending on September 9. Likewise, Bud Light sales witnessed a staggering decline of roughly 30% in both volume and dollar worth in the month leading up to September 9, compared to the prior-year period.

Moreover, BUD witnessed a plunge in U.S. revenue in the second quarter, primarily driven by the social media-led boycott. The brewer’s second-quarter revenue in the U.S. saw an alarming 10.5% decline, while operating profits experienced a nearly 30% decrease.

The boycott's impact stretched far beyond the immediate sphere, impacting BUD's primary operations and creating ripple effects across its associated enterprises such as breweries, distributors, and labor force. An unfortunate repercussion was the reported bombing threats targeted at select breweries, accompanied by incidents of employee harassment.

The backlash grew so extensively that it prompted HSBC to downgrade BUD's stock. In June, Mexican lager Modelo Especial dethroned Bud Light, claiming the title of America's favorite beer, a position Bud Light had defended for over two decades.

Nevertheless, enduring these challenges, BUD enjoyed a surge in global profits due to price increases and strengthening sales in markets outside the U.S. Its operational presence spread across various international markets facilitates business diversification and alleviates the effects of adverse publicity.

Its leading portfolio contributed to a mid-single-digit revenue rise, somewhat counter-balancing the declining Bud Light sales in the U.S. This was propelled by a double-digit growth occurrence in South Africa and Colombia.

Several analysts suggested that the stock’s depreciation may be an overreaction, proposing that the company could recover even amid the backlash. In alignment with this view, Bank of America upgraded its rating on BUD, positing that the brewing titan boasts a diversified brand portfolio, widespread geographic presence, and potential for margin expansion.

In the prevailing environment, Bank of America labeled the brewer a "relatively defensive stock," projecting positive earnings growth for the company in 2023. Following the upgrade to a 'Buy' from a 'Neutral' standing, BUD's stock prices ascended approximately 4%.

With BUD recording impressive revenue figures exceeding $57 billion last year, it is challenging to predict how much boycotts alone can substantially disrupt its financial stability. The following key factors could notably sway the future trajectory of the brewing behemoth:

Mixed Financials

During the fiscal second quarter that ended June 30, 2023, BUD’s revenue rose 2.2% year-over-year to $15.12 billion. Its gross profit grew 1.3% from the prior-year quarter to $8.10 billion.

However, the company’s normalized EBITDA declined 3.7% from the year-ago quarter to $4.91 billion. Also, underlying profit attributable to equity holders of BUD and earnings per share fell 1.1% and 1.4% year-over-year to $1.45 billion and $0.72, respectively.

Mixed Valuation

BUD’s forward EV/Sales and Price/Sales of 3.12x and 1.74x are 84.9% and 62% higher than the industry average of 1.69x and 1.07x, respectively. However, its forward non-GAAP PEG multiple of 1.56 is 27.7% lower than the industry average of 2.15. Also, its EV/EBITDA multiple of 9.31 is 18.7% lower than the industry average of 11.45.

Robust Profitability

BUD’s trailing-12-month gross profit and levered FCF margins of 54.21% and 11.84% are 64.5% and 247.4% higher than the industry averages of 32.96% and 3.41%, respectively. Its trailing-12-month cash from operations of $12.71 billion is significantly higher than the industry average of $457.15 million.

Growing Interest of Smart Money

A notable activity around BUD's shares has been observed, indicating a climate brimming with significant trading interest. The ongoing boycotts seem to have fallen short of nullifying the belief in the beer giant’s potential recovery.

Confirming this outlook, the Bill & Melinda Gates Foundation Trust, under the stewardship of business titan Bill Gates, secured 1,703,000 shares of BUD. This acquisition is estimated at about $95 million and asserts renewed faith in the brand’s value.

Notably, several institutions have recently modified their BUD stock holdings. Of the 567 institutional holders, 211 have increased their positions in the stock. Moreover, 70 institutions have taken new positions (4,737,413 shares).

Price Performance

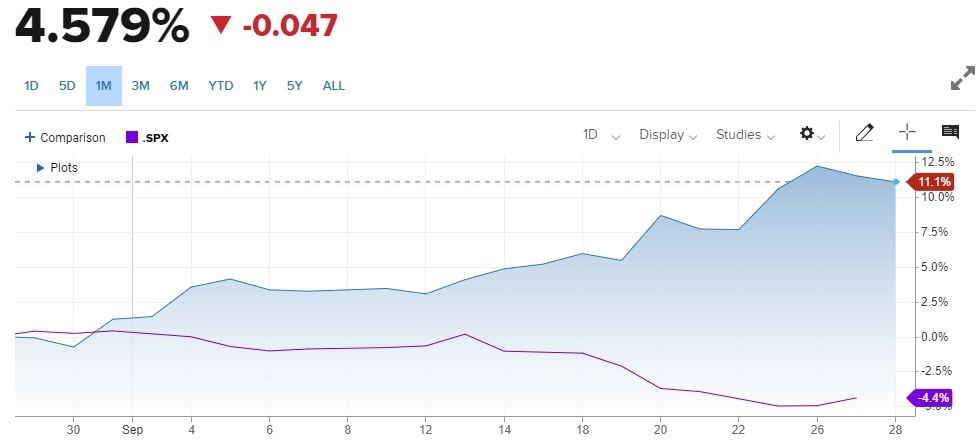

BUD’s shares have plunged more than 20% over the past six months but gained more than 15% over the past year. The stock also trades below its 50-day and 100-day moving averages of $56.47 and $56.80, respectively, indicating a downtrend.

However, Wall Street analysts expect the stock to reach $67.56 in the next 12 months, indicating a potential upside of 27.5%. The price target ranges from a low of $57.59 to a high of $76.

Mixed Analyst Estimates

For the fiscal third quarter ending September 2023, BUD’s revenue and EPS are expected to come at $15.98 billion and $0.85, up 5.9% and 4.5% year-over-year, respectively.

For the fiscal year ending December 2023, BUD’s revenue is expected to increase 6% year-over-year to $61.28 billion, whereas its EPS is expected to decline 3.8% year-over-year to $3.03.

Bottom Line

In an unusual turn of events, the latest controversy involving social media influencers associated with BUD has reportedly sent ripples through its stock prices. The handling of this incident by the beverage company and the resulting negative media coverage has left investors perturbed about potential harm to its corporate image. The boycotts engulfing BUD brands only raise concerns about a possible negative hit on revenue.

Another industry development provoking potential unease for BUD's future market position is the impending entry of Tilray Brands into the beer market, which could further challenge BUD's financial foothold.

The collateral damage from the backlash notably seems concentrated within developed markets like the U.S. However, analysts indicate that the sell-off wave may have peaked, adding that the overall disturbance could have limited repercussions outside U.S. borders. Many specialists see the decline in BUD's stock valuation as an attractive entry point for prospective investors.

Signs of continuing faith in the beleaguered beer company's resilience are reflected in Bank of America’s upgrade during the turmoil and noteworthy investments made by institutions. Such actions underline hint at BUD's perceived capability to recover and enhance its market value over time.

However, considering it tepid price momentum, mixed financial indicators, and analyst estimates, it might be in investors' best interest to wait for a more opportune entry point in the stock.