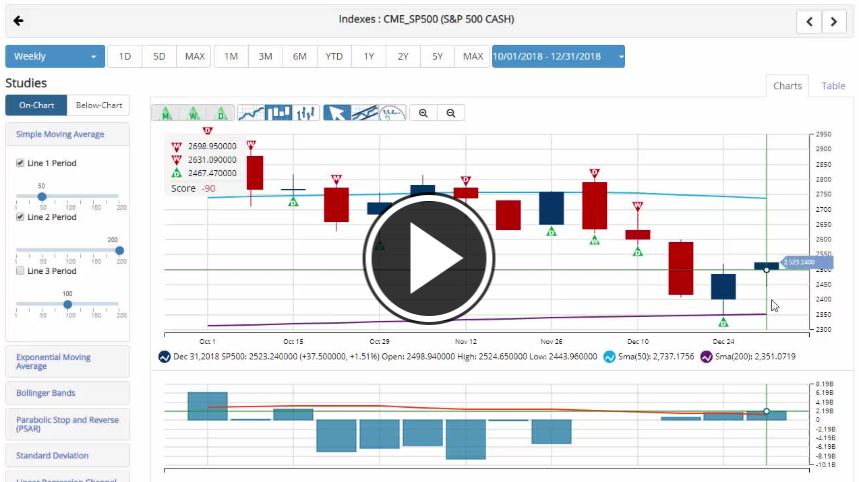

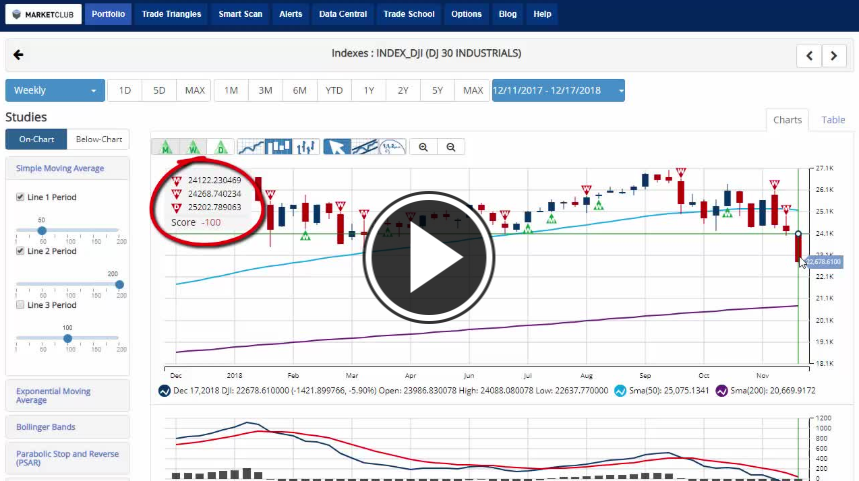

Hello traders everywhere. All three major indexes are looking to finish the week on a strong note and post back to back winning weeks for the first time in nine weeks. The reason for the surge after a terrible day on Thursday, jobs.

Nonfarm payrolls jumped by 312,000 jobs last month, the largest gain since February, as employment at construction sites snapped back after being restrained by unseasonably cold temperatures in November.

There were also broad gains in hiring last month. Data for October and November were revised to show 58,000 more jobs added than previously reported. The economy created 2.6 million jobs last year compared to 2.2 million in 2017.

Average hourly earnings rose 11 cents, or 0.4%, in December after gaining 0.2% in November. That lifted the annual increase in wages to 3.2%, matching October's rise, from 3.1% in November. The average workweek increased to 34.5 hours in December from 34.4 hours in November. Continue reading "Market Rallies On Strength Of Jobs Report"