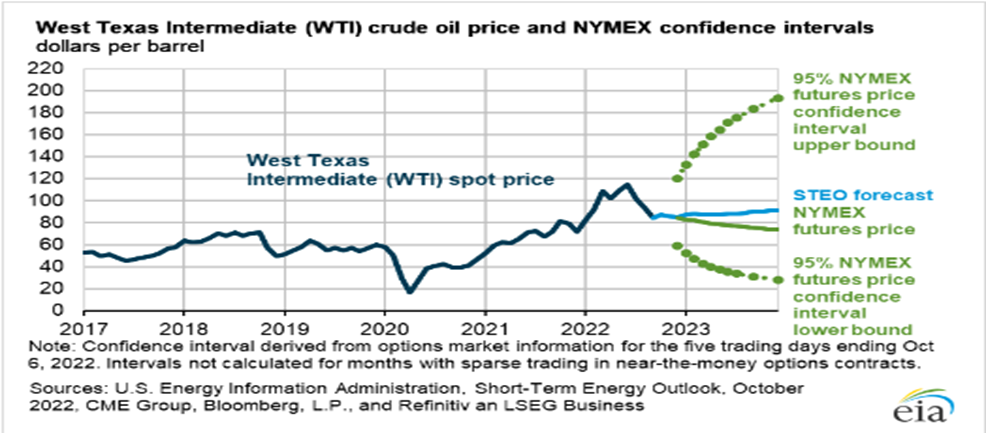

With fast and furious rate hikes yet to succeed in bringing inflation under control, the stock market is expected to witness further volatility. However, the energy sector remains well-positioned to thrive with tight supply and rising global demand pushing oil prices higher.

While OPEC+’s decision to cut oil production by 2 million barrels/day and limited availability of Russian oil will keep supply tight, OPEC expects global oil demand to increase to 103 million barrels per day (BPD) next year.

Besides being the relatively cleaner alternative among fossil fuels, the natural gas liquid market is set to grow at 5.7% CAGR to reach $29 billion by 2030. Hence, it would be opportune to capitalize on the industry tailwinds and load up on oil and gas stocks Diamondback Energy, Inc (FANG) and Baker Hughes Company (BKR) as some technical indicators point to solid upsides.

Diamondback Energy, Inc (FANG)

FANG is an independent oil and gas company with a market capitalization of $34.89 billion. The company is involved in acquiring, developing, exploring, and exploiting unconventional, onshore oil and natural gas reserves in the Permian Basin in West Texas. It operates through two segments: the upstream segment and the midstream operations segment.

Over the last three years, FANG’s revenue grew at a 44% CAGR, while its EBITDA grew at 41.7% CAGR. Over the same time horizon, the company’s net income grew at a 67.2% CAGR.

During the third quarter of the fiscal year 2022, ended September 30, FANG’s total revenues increased 27.6% year-over-year to $2.44 billion. During the same period, the company’s income from operations increased 38.7% year-over-year to $1.61 billion, while its adjusted EBITDA increased 68.2% year-over-year to $1.91 billion.

FANG’s adjusted net income for the quarter came in at $1.14 billion or $6.48 per share. Due to high cash margins, and best-in-class well costs, the company generated nearly $1.2 billion in free cash flow, of which it returned around 75% to shareholders through share repurchases and dividend payouts. Continue reading "2 Oil and Gas Stocks for the Long Term"