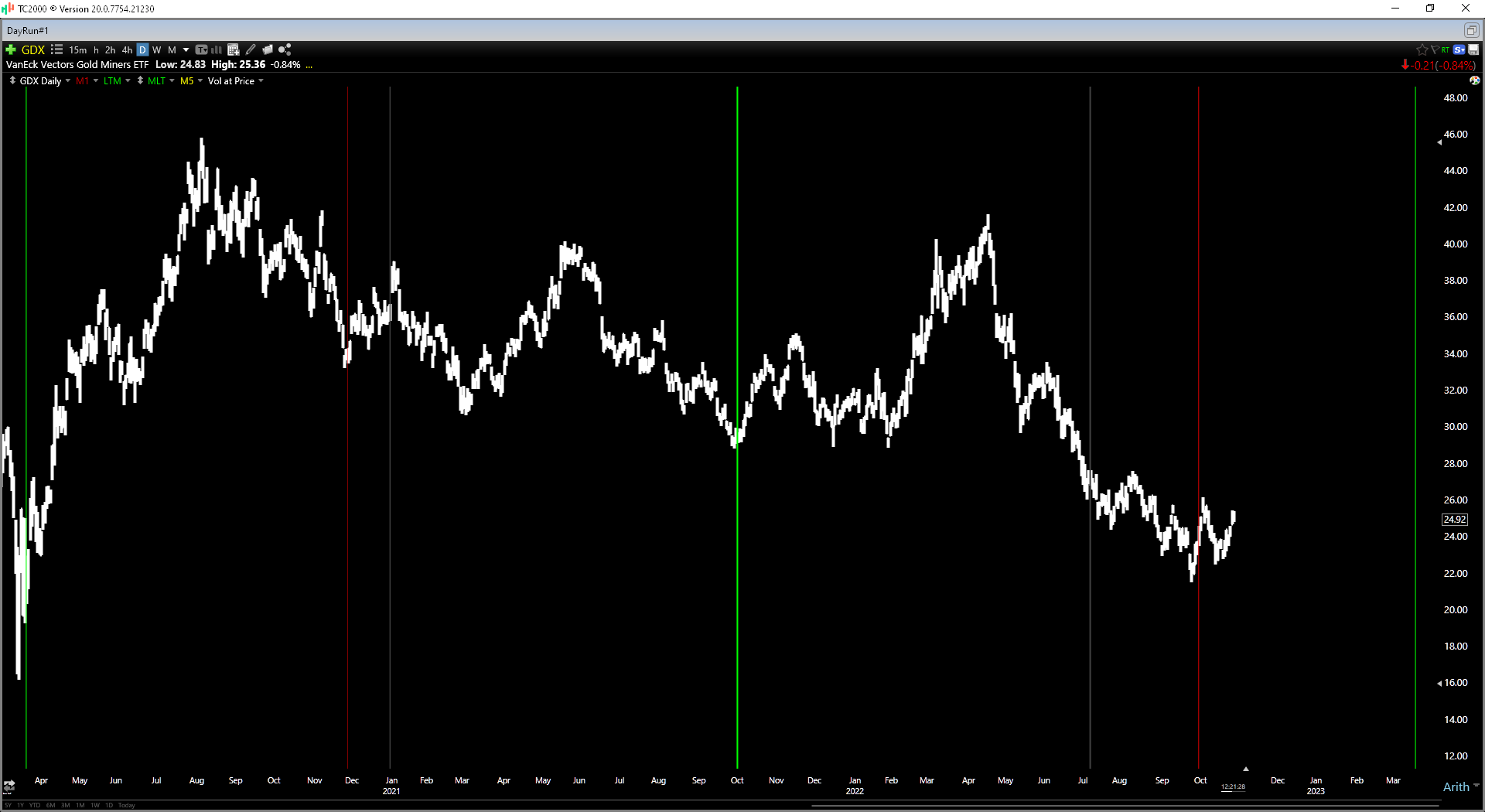

It’s been a volatile year for the major market averages, and the Nasdaq Composite (COMPQ) remains down 28% for the year and on track for its worst annual decline since 2008.

The difference this time is that it’s coming off a multi-year win streak and a more than decade-long bull market, making the current sell-off look more similar to 2000 than the 2008/2009 lows.

That said, for investors willing to look outside of the traditional FAANG names that have massively outperformed for years, there are always opportunities to hunt down alpha. This update will look at two general market names trading at deep discounts to fair value.

Builders FirstSource (BLDR)

Builders FirstSource (BLDR) is the largest supplier of structural building products, value-added components, and services to the professional market for the single-family and multi-family construction/repair/remodeling market in the United States.

The company has ~560 distribution/manufacturing locations across 42 states and boasts a market cap of $9.7BB.

Unfortunately, though, with the housing market teetering on a recession with new and existing home sales down sharply, investors have become worried about buildings products name, and Builders FirstSource hasn’t been immune from this anxiety despite continuing to put up phenomenal results.

In fact, the company just recently reported revenue of $5.8BB (+ 5% year-over-year) and adjusted annual EPS of $5.20, a 53% increase from the year-ago period.

Notably, these results were lapping already difficult comparisons from the year-ago period, with Q3 2021 annual EPS up 308% in the year-ago period. The strong growth in earnings was driven by ~20% growth in its higher-margin value-added products combined with aggressive share repurchases, repurchasing $2.0BB in shares to date (~30% of common shares).

Normally, I would be skeptical of a company growing annual EPS through share buybacks and buying back shares to this degree, given that many companies have a bad habit of buying back shares to prop up earnings vs. doing it opportunistically.

However, Builders FirstSource’s core business is strong with growth in its key segments (core organic sales in Value-Added Products up 20%, Repair, Remodel & Other up over 30%), and the stock is significantly undervalued. Continue reading "Two Value Stocks To Buy On Dips"