Once again I have to disclaim that at the moment (and for quite some time now) I hold not one single short position, in anything. I am only long US and global stocks. But also managing cash and portfolio balance as usual while feeling as though I’m playing a game of Musical Chairs while the music still plays (nothing nearly as good as Keith’s style, which has always resonated with me beyond most others).

I have to disclaim the bull positioning because book talkers tend to talk about their book. My book is only long insofar as I have equity positions because in a manic up phase I have little interest in eroding the situation with short hedging. Besides, gold stocks are doing that balancing job right now and that balancing act has been working well since June.

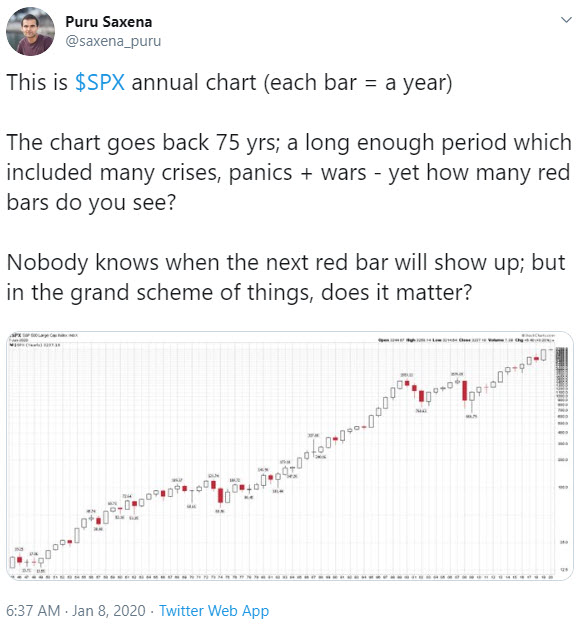

Anyway, here is a tweet from a well-followed commentator that is framed so logically and paints the 2008 crash as merely a blip that you or I could do standing on our heads.

Equities… just stay in and prosper! No problem in real-time because the US stock market always comes back… ALWAYS. This is the kind of stuff that appears near tops; like stuff that uses ultra long-term yearly charts in log scale to smooth out the problems.

So the next time this happens, try to forget that it was caused by epic policy distortions within the system the likes of which have been amped up exponentially since and just remember it’s actually a smooth ride assuming the next thing is like the last thing and you live long enough to reap the benefits.